Sustainability reporting is a hot topic as more and more companies are required to report on their sustainability efforts. This is due not only to stricter legal requirements, but also to market expectations.

Current EU sustainability reporting obligations

Under the EU Non-Financial-Reporting Directive (NFRD) and its national implementation, large public interest entities have been legally obliged to prepare and publish an annual report on their sustainability efforts since 2014. Since 2022, companies within the scope of the relevant implementing legislation of the NFRD must also fulfil the supplementary reporting obligations of the EU Taxonomy Regulation in their non-financial statement. For this purpose, these companies must review their business activities and determine the extent to which they contribute substantially to six specified EU environmental goals. In Germany, since 2023, there have been additional sustainability-related reporting obligations under the German Supply Chain Due Diligence Act, for companies with more than 3,000 employees, and from 2024 onwards, these will be extended to companies with more than 1,000 employees. Other EU Member States may also have additional obligations.

Upcoming mandatory reporting obligations under CSRD

Sustainability reporting obligations will soon be significantly expanded under the new EU Corporate Sustainability Reporting Directive (CSRD), which replaces the current NFRD. While the NFRD affects about 11,000 companies across Europe, the CSRD will cover about 50,000 companies. It will be introduced in four phases in order to give companies sufficient time to prepare:

- Companies already obliged to report under the current NFRD must now report in their management reports in accordance with the CSRD from the financial year 2024 onwards. This initially only affects large public interest entities, i.e. capital market-oriented companies, financial service providers and insurance companies with more than 500 employees and either a balance sheet total of more than €25 million or net sales of more than €50 million.

- From January 2026, the published management reports for the financial year 2025 must be prepared in accordance with the CSRD by all companies and consolidated groups that qualify as large companies or large groups under the Accounting Directive (2013/34/EU). Large companies are all corporations that fulfil at least two of the following three characteristics: balance sheet total over €25 million; net sales revenue over €50 million; or more than 250 employees. Similar thresholds apply to large groups on a consolidated basis.

- The next phase will apply to all listed small and medium-sized enterprises (SMEs), as well as small and non-complex credit institutions and insurance companies. Small companies in the context of the Accounting Directive are enterprises that do exceed at least two of the following three size criteria: balance sheet total €450.000; net turnover €900.000; average number of 10 employees. Medium-sized enterprises are those that are neither micro, small nor large. These companies must publish their management reports for the 2026 financial year in compliance with the CSRD from January 2027 onwards. However, an opt-out clause is provided for SMEs which exempts them from the application of the Directive until 2028, provided they explain in their management report why the required information is not yet available.

- From January 2029 onwards, even non-EU companies will have to publish their sustainability information for the 2028 financial year in accordance with the CSRD. This applies to all companies which have their legal seat outside the EU but which achieve a turnover of more than €150 million in the EU and additionally have either a reportable EU subsidiary as mentioned above, or an EU branch with net sales revenue of €40 million or more. In this case, the sustainability information of the non-EU parent company needs to be included in the management report of its EU subsidiary or branch. Before 2029, the respective EU subsidiary of the non-EU parent company needs to report under CSRD on its own account.

Commercial pressures

While legal obligations for sustainability reporting currently only apply to larger EU companies, the actual importance of reporting is growing steadily, particularly for small and medium-sized companies (SMEs). Larger companies, which are already subject to legal reporting obligations, usually also have to report on the sustainability efforts of their (smaller) suppliers and business partners as part of these reporting obligations. As a result, these smaller companies are increasingly being asked by their larger contractual partners to submit a report on their own sustainability efforts. If they refuse to do so, the larger business partner might threaten to terminate the business relationship.

This commercial pressure to report arises not only within traditional supply chains, but also in the context of other contractual relationships for SMEs. Commercial borrowers, for example, are regularly requested by their banks to submit sustainability information when applying for a loan. The same applies, for example, to start-up companies whose business shares are in the hands of a financial investor. Financial investors, in particular, demand sustainable action from their investment companies. For these reasons, more and more companies are introducing ESG (Environmental, Social and Governance) sustainability structures in their company, even when not legally obliged to do so.

How should CSRD sustainability reports be structured?

The CSRD suggests sustainability reports could include information answering the following questions:

- How are sustainability-relevant impacts of business activity taken into account in the business model and corporate strategy?

- What are the company’s sustainability goals and what progress is being made on them?

- What role do the administrative, management and supervisory bodies play in connection with sustainability efforts? Is there an incentive system for them?

- How does the company intend to ensure that its business model and strategy are compatible with the transition to a sustainable economy and limiting global warming to 1.5°C in line with the Paris Agreement and the goal of climate neutrality by 2050 under the European Climate Change Act?

- What opportunities exist for companies in connection with sustainability concerns? What sustainability risks affect the company’s operations

- What actual or potential negative impacts are associated with the company’s business activities and value chain?

- Has a risk analysis or due diligence been carried out in relation to sustainability issues?

- What measures have been taken to prevent or minimise adverse impacts and what is their impact? What policies are in place regarding sustainability issues?

European Sustainability Reporting Standards (ESRS)

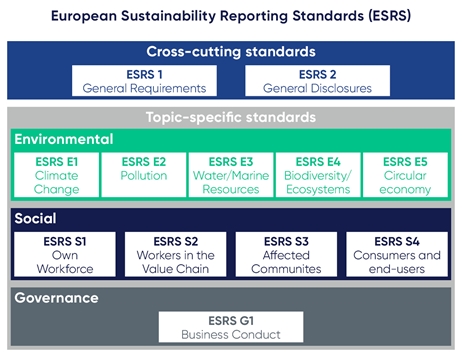

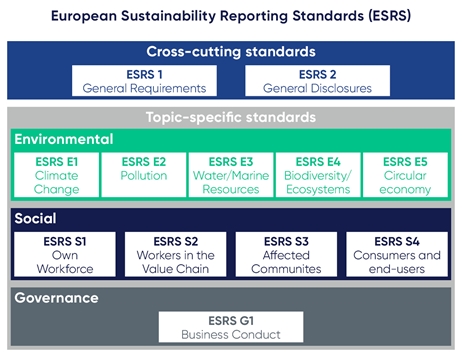

Based on the CSRD, the EU Commission has mandated the European Financial Reporting Advisory Group (EFRAG) to develop binding EU standards for sustainability reporting, known as the European Sustainability Reporting Standards (ESRS).

These ESRS have been adopted by the EU Commission and came into force in December 2023. The standards do not have to be transposed into national law, but are directly applicable to all companies affected by the CSRD.

The ESRS contain twelve separat standards with a total of more than 80 individual disclosure requirements. These standards are divided into two cross-cutting standards and ten topic-specific standards, including five on environmental, four on social and one on governance issues.

ESRS 1 sets out general requirements, and in particular the requirements for sustainability due diligence and materiality analysis. The purpose of these two processes is to determine which sustainability aspects are material for the reporting company. In this respect, the principle of dual materiality is assumed, which means that the company has to review

- which sustainability issues arise from the company and have or can have an impact on people or the environment (impact materiality), or

- which sustainability issues have or can have a financial impact on the company, i.e. on the development, performance and position of the company (financial materiality).

The other 11 standards of the ESRS describe specific disclosure requirements in considerable detail. The standards contain 20 to 40 pages each. Often, one standard cross refers to another.

These will not, however, be the last standards in relation to CSRD. Additional sets of ESRS are planned over the next years: a wide array of sector-specific standards that will be mandatory for all large companies within their respective business sector; slimmed down standards for SMEs and standards for non-EU companies.

What to do now

More and more companies are subject to sustainability reporting requirements. Although statutory reporting requirements already exist, the CSRD greatly broadens the scope of obligations and the detail of reporting required. Complying with the CSRD, the ESRS and further guidelines will be an enormous challenge for many businesses. Whether or not the ESRS actually make the reporting obligations manageable remains to be seen, but companies likely to be in scope should begin preparing now, including by carefully considering the required reporting standards. This is likely to take time. So even where legal requirements are still some way off, it will be worth preparing now, particularly given the additional commercial impetus to report.