From 1 April 2021, non-resident individuals, companies and trustees will pay an extra 2% stamp duty land tax (SDLT) on purchases of residential property.

This 2% surcharge will apply whether the purchaser intends to occupy the property as their main residence or not and will apply on top of existing SDLT rates - including the 3% surcharge which applies where an individual purchaser already owns a residential property (anywhere in the world), or a property is purchased by a company. This means that the top rate of SDLT for properties valued at more than £1.5m is now 17%.

Specific "SDLT residence tests" apply for these purposes. The UK's statutory residence test (SRT) (which determines an individual's residence for income tax and capital gains tax purposes) will not be used to determine whether an individual purchaser is resident or non-resident for SDLT purposes. It is possible that you could be UK tax resident under the SRT and subject to UK tax on your worldwide income and gains but be non-resident under the SDLT residence tests and subject to the 2% SDLT non-residents surcharge on the purchase of your UK home.

The surcharge will not apply where a contract to purchase the property was exchanged before 11 March 2020, or the contract was entered into and substantially performed before 1 April 2021.

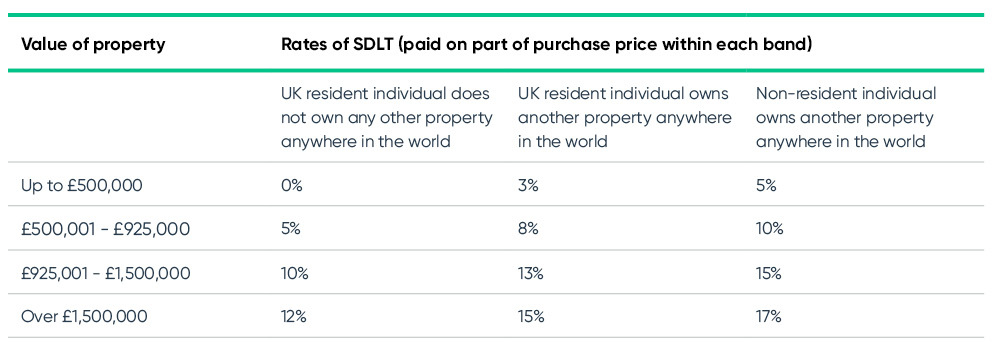

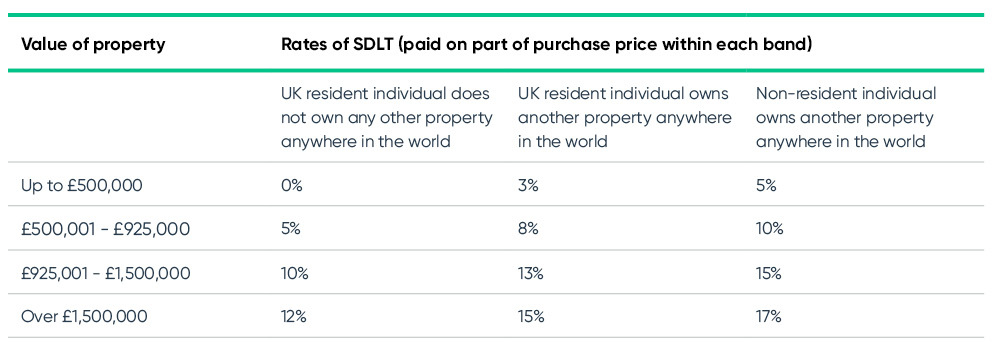

Rates of SDLT

The SDLT rates that will apply to purchases by individuals from 1 April 2021 to 30 June 2021 are set out below. The amount of the purchase price that falls within the lowest SDLT band will be reduced to £250,000 from 1 July 2021; and then to £125,000 from 1 October 2021.

Individual purchasers

An individual purchaser will be resident (and so not subject to the 2% SDLT surcharge) if they were in the UK at midnight on 183 days or more during any continuous period of 365 days that falls within the period starting a year before, and ending a year after, the date of purchase. Otherwise the individual is non-resident for SDLT.

An individual who has spent little or no time in the UK before purchasing a residential property but then moves to the UK and spends at least 183 midnights in the UK in the year following the purchase will be eligible for a refund of the surcharge. The SDLT return must be submitted within the usual time limit but can be amended at any time within two years of the purchase, and the refund claimed.

Individuals who are internationally mobile will need to bear in mind that HMRC will look for evidence that establishes an individual's presence inside or outside the UK; this could include credit card or bank statements showing day-to-day expenditure, mobile phone usage, utility bills or work diaries. This list is not exhaustive.

If a property is being purchased jointly and one of the purchasers is non-resident under the SDLT residence tests the 2% SDLT surcharge will apply. The exception to this is where the purchasers are a married couple or civil partners one of whom is resident and one of whom is non-resident – in that case the non-resident will be treated as UK resident for these purposes so that the surcharge will not apply.

Partnerships

The 2% surcharge will apply if any one of the partners is non-resident (under the SDLT residence test). Whether an individual partner is resident or non-resident will be determined by applying a modified version of the rule for individual purchasers. An individual partner is resident if they were in the UK at midnight on 183 days or more in the 365 days ending on the date of the purchaser.

Trusts

The 2% SDLT surcharge will apply to a purchase by a non-resident discretionary trust. The residence of a trust will be determined in the same way as for other tax purposes – so if all the trustees are non-resident, the trust will be non-resident. An individual trustee is resident, for these purposes, if they were in the UK at midnight on 183 days or more in the 365 days ending on the date of the purchaser.

If a beneficiary of a trust is entitled to live in the purchased property for life, or is entitled to the income arising from the property (e.g. it is a life interest trust), then that beneficiary will be treated as if they were buying the property and what will be important is whether they are resident or non-resident (under the SDLT resident test).

Bare trusts and nominee arrangements are ignored for SDLT purposes so that the 2% surcharge will apply if the beneficiary (or one of the beneficiaries) of the bare trust is non-resident (under the SDLT resident test).

Companies

A company will be non-resident, and subject to the 2% SDLT surcharge, if it is not resident in the UK for UK corporation tax purposes. A UK resident close company (broadly, one controlled by five or fewer people) will also be subject to the 2% SDLT surcharge if it is under the control of one or more non-resident persons.

Reliefs

Existing SDLT reliefs will, in most cases, still apply.

The purchase of property that is a mix of residential and non-residential property is still subject to SDLT at the non-residential SDLT rates – the maximum rate of SDLT on non-residential property is 5% (this rate applies where the purchase price is over £250,000).

Where six or more residential properties are bought in a single transaction the non-residential rates of SDLT also continue to apply. Purchases of a number of residential properties (but fewer than 6) in one transaction, will be eligible for multiple dwellings relief which reduces the rates of SDLT that apply to each of the properties by using the average price for the properties.