The Taskforce on Inequality and Social-related Financial Disclosures (TISFD) was launched on 23 September 2024, with the publication of 'People in Scope: An overview of the proposed scope, approach, governance structure and the work plan of the Taskforce on Inequality and Social-related Financial Disclosures' (Launch Paper).

Complementing the work of the Task Force on Climate-related Financial Disclosures (TCFD) and Taskforce on Nature-related Financial Disclosures (TNFD), each of which has established frameworks for organisations to disclose decision-useful information to stakeholders relating to climate and nature-related risks and opportunities respectively, the TISFD is intended to result in a global disclosure framework for the disclosure of inequality and social-related impacts, dependencies, risks, and opportunities.

TISFD: background and purpose

TISFD is the product of predecessor initiatives, having been formed through the consolidation in mid-2023 of the Taskforce on Inequality-related Financial Disclosures with organisations that had been preparing a Taskforce on Social-related Financial Disclosures.

The Launch Paper is the result of a significant engagement process between the Taskforce's 'Founding Partners' and over 1,000 stakeholders drawn from commerce, academia, civil society and international organisations. As part of this process, the TISFD has drawn on the experiences of TCFD and TNFD and engaged with the work of the International Sustainability Standards Board (ISSB) (formed by the International Financial Reporting Standards (IFRS)), the Global Reporting Initiative (GRI) and the European Financial Reporting Advisory Group (EFRAG).

As the Launch Paper notes at the outset, referring to the remarks of the UN Secretary General, and the G20 Finance Ministers and Central Bank Governors (which met in Brazil in February 2024), a combination of record increases in wealth inequality and a severe cost of living crisis has resulted in calls to action for more investment in people and a just transition to net zero that takes account of the environmental, economic and social dimensions of sustainability.

Extreme levels of inequality pose a significant risk to market actors, as they can cause the breakdown of social cohesion, slow down the growth of human capital, and endanger financial stability. Market participants that integrate social factors and inequalities into their decision-making processes are better placed to:

- sustain their workforce

- boost innovation and productivity

- promote strong relationships with communities and consumers, and

- ensure the resilience of both their businesses and investment portfolios.

Such organisations in turn contribute to an improvement in overall human and economic well-being, building more resilient economies and increasing prosperity for everyone.

However, the integration of 'people' related risks requires high-quality data and metrics, which is currently not available. The function of the TISFD is develop an evidence-based global framework, which adopts a coherent approach and enables companies and financial institutions to assess and disclose:

- their impacts and dependencies on people

- their overall impact of their activities on inequalities, and

- consequential risks and opportunities on their financial returns in the short, medium and long term.

Businesses and financial institutions: impacts, dependencies, risks and opportunities

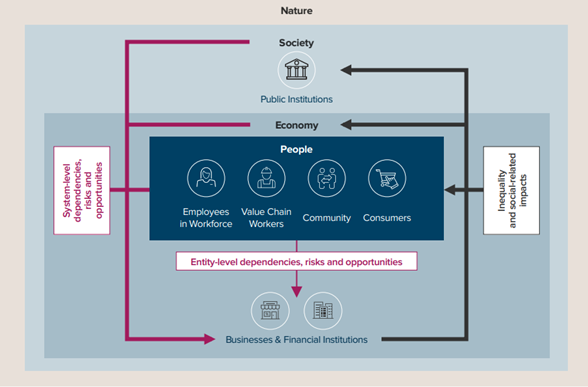

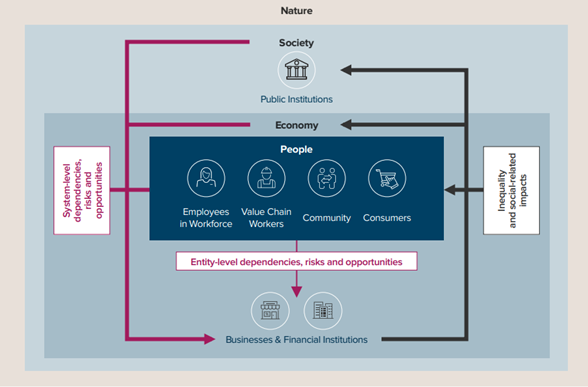

The diagram below, reproduced from page 11 of the Launch Paper, illustrates the relationship between businesses and financial institutions and the core concepts at the heart of the TISFD: inequality and social-related impacts, dependencies, risks and opportunities (IDRO).

Under the bonnet of the TISFD: impacts, dependencies, risks and opportunities

A business or financial institution can have a range of impacts on people and society. Such impacts can be categorised according to whether they are:

- positive or negative

- intentional or unintentional, and

- direct or indirect.

Impacts on people include employees (for example, through remuneration, benefits, working conditions, training opportunities, how employees are managed, diversity, equity and inclusion), workers in value chains (for example, how decisions are made to source workers in the value chain and how this impacts the pay and condition of workers), communities (for example, the impact a business has on land, housing or access to water) and consumers (for example, how the products and services of businesses or financial institutions impact on an individual's physical or mental wellbeing, social connections, financial security and knowledge and skill development).

The activities of businesses and financial institutions also give rise to a range of indirect impacts on people and society as a result of their engagement with public institutions (including policymakers) and economies (including through competitive or anti-competitive practices).

Financial institutions can play a fundamental role in shaping outcomes for people and inequalities in their approach to capital allocation and structuring (including how investments and loans are structured) and engagement with investees (their ability to influence how investee companies operate through roles on investees' boards or board committees).

To operate and grow sustainably, businesses and financial institutions have a range of dependencies including the skills, competencies, wellbeing and trust of their workforce, communities, consumers and the end-users of their products and services, as well as the overall stability of the economy and society.

Impacts and dependencies can give rise to entity-level risks and opportunities for businesses and financial institutions. The combined impacts of businesses and financial institutions can lead to high levels of inequality, which can contribute to systemic risks for businesses and financial institutions.

What are the proposed deliverables of the TISFD?

- A global disclosure framework that recommends disclosures for businesses and financial institutions regarding their inequality and social-related IDROs, which is aligned with the four-pillar approach that informs the TCFD and TNFD and which is used in IFRS's sustainability disclosure standards (i.e. governance, strategy, risk management, and metrics and targets).

- Guidance and recommendations for businesses and financial institutions on how to implement the disclosure framework, which will include guidance on metrics and data.

- Bespoke educational and capacity-building resources for a range of stakeholders and audiences, which includes different kinds of businesses and financial institutions but also policymakers, trade unions and civil society organisations.

- Conceptual foundations that make clear the connections between the activities and interests of business and finance on the one hand, and positive and negative outcomes of people on the other. This workstream will include a consideration of commonly used taxonomies for inequality and social-related outcomes and key definitions and terminology, with a focus on what materiality means in the context of disclosures.

- A body of evidence that gathers together research on social-related financial risks and systemic risks of inequality for businesses and financial institutions that will be accessible to market participants, clearly showing those social issues that are directly relevant to short, medium and long-term financial outcomes.

Core design principles

The outputs of the TISFD will be informed by six design principles:

- Market-usable: recommendations should be directly useful and valuable to those preparing and using information.

- Alignment with standards of business conduct: the recommendations should be aligned with international standards on business conduct such as the UN Guiding Principles on Business and Human Rights, the International Labour Organisation Tripartite Declaration of Principles concerning Multinational Enterprises and Social Policy, and the OECD Guidelines for Multinational Enterprises on Responsible Business Conduct.

- Integration with reporting standards: the TISFD should draw on existing reporting standards and frameworks, while addressing any gaps where appropriate.

- Supportive and informative: the TISFD should work together with existing standard-setting bodies including the IFRS, the GRI and the EFRAG and jurisdictions with an interest in introducing mandatory sustainability-related disclosures to promote the adoption of the TISFD's recommendations.

- Linking people and planet: the TISFD's work should reflect the close relationship between inequality and social-related issues and action taken to address climate change and nature loss, building on the TCFD and TNFD recommendations.

- Globally relevant: recommendations should be relevant across all economies, whether developed, emerging or developing.

Phased approach

The Launch Paper outlines a phased approach to the work of the TISFD.

Phase 0 – Prepare, Phase 1 – Launch, Phase 2 – Build stakeholder capacity

Having undertaken preparatory work and established the necessary governance bodies (Phase 0 and Phase 1 respectively; Phase 0 was undertaken prior to the publication of the Launch Paper and the Launch Paper forms a significant component of Phase 1), the focus will move to building stakeholder capacity (Phase 2).

Phase 3 – Define and refine

Then, in 2025, attention will turn to developing the conceptual framework underpinning the new disclosure regime and researching existing literature on the impacts and dependencies of business and financial institutions on social and inequality-related outcomes, and the financial risks and opportunities that arise out of such impacts and dependencies.

Phase 4 – Develop and test framework

In late 2025, work is likely to being on developing a beta version of the disclosure framework drawing on the output of Phase 3.

Phase 5 – Publish

The first public version of the disclosure framework is expected to be released at the end of 2026 together with guidance and recommendation on how it should be implemented, including relating to the design and use of indicators and metrics. This phase will also see the development of educational and capacity building resources (see the list of proposed deliverables above).

Phase 6 – Implement and advocate

In this final phase, the Taskforce will work alongside other standard-setters and jurisdictions to consider how the TISFD recommendations can guide and bolster existing and future standards and regulations. It will also support businesses and financial institutions that seek to use its recommendations. At this stage, it may explore whether additional tailored guidance is required to ensure the effective and global adoption the recommendations.

Conclusion

The launch of the TISFD represents a significant milestone in global efforts to address the critical issue of inequality and social-related impacts. While widespread adoption of the final disclosure framework is some years away (the framework itself is not expected until the end of 2026), the publication of the Launch Paper will encourage businesses and financial institutions to begin their journey of considering how best to articulate relevant inequality and social-related impacts, dependencies, risks and opportunities.

This article has been published in www.compliancemonitor.com and www.i-law.com.