Recently introduced EU rules impose mandatory reporting obligations on advisers, and in some cases taxpayers, regarding certain cross-border arrangements.

Potentially catching transactions dating back to June 2018, and with penalties of up to £1 million for non-compliance, we explain what DAC 6 is and how we can assist you with it.

What is DAC 6?

The sixth version of the Directive on Administrative Co-operation – or DAC 6, as it is more commonly known – is an EU directive that aims to tackle tax avoidance, increase tax transparency and improve information sharing between the EU member states (each of which has implemented its own rules).

It introduces new obligations on intermediaries such as lawyers, accountants, tax advisers and banks to report details of certain cross-border arrangements to their local tax authority. This information will then be exchanged with other tax authorities implementing equivalent rules.

In the absence of a reporting intermediary – for instance, where a transaction is carried out in-house, or where legal professional privilege prevents disclosure – the reporting obligation will fall on the taxpayer to whom the cross-border arrangement is made available. This can apply to any taxpayer, including companies, individuals and trustees.

What is a reportable cross-border arrangement?

A cross-border arrangement is a scheme, transaction or series of transactions that concerns more than one EU member state, or an EU member state and a third country. The UK is treated as an EU member state until the end of the transition period (31 December 2020), although the UK's DAC 6 regime is expected to survive Brexit.

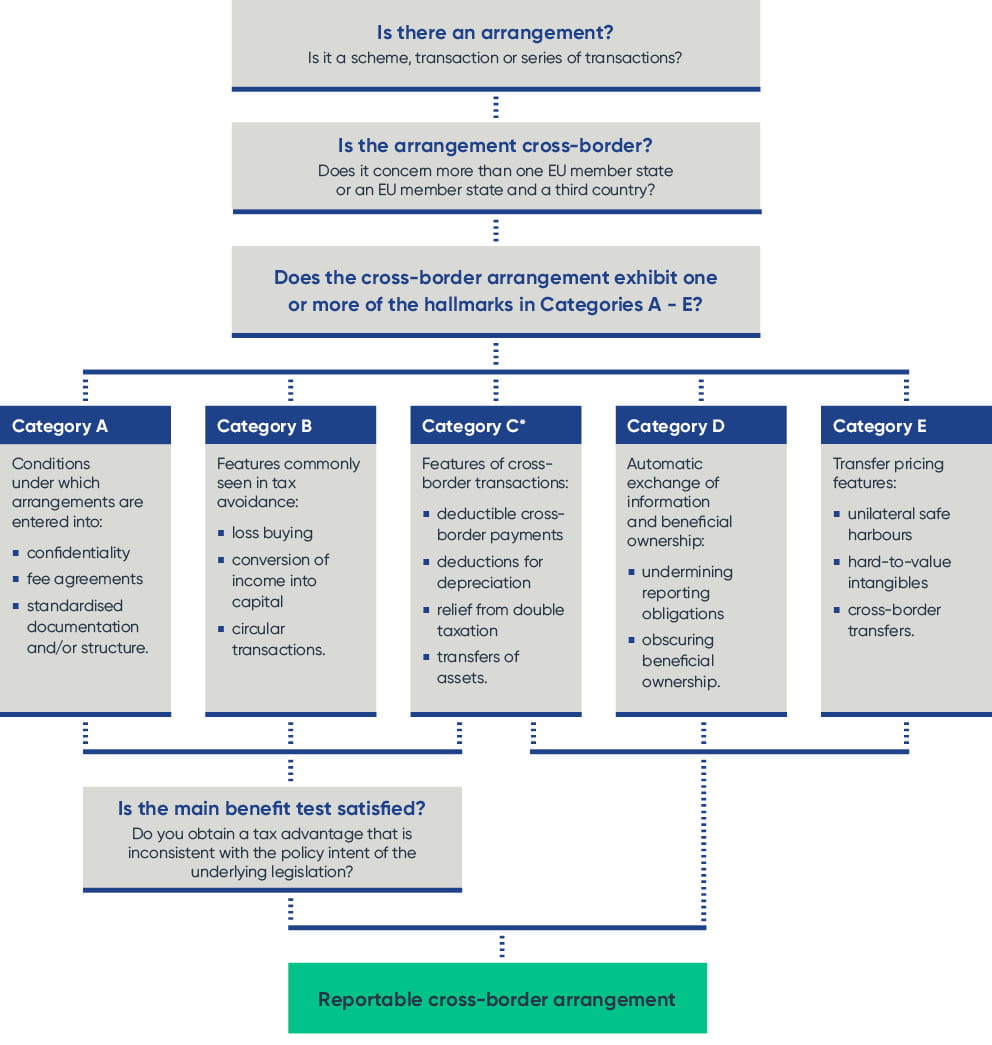

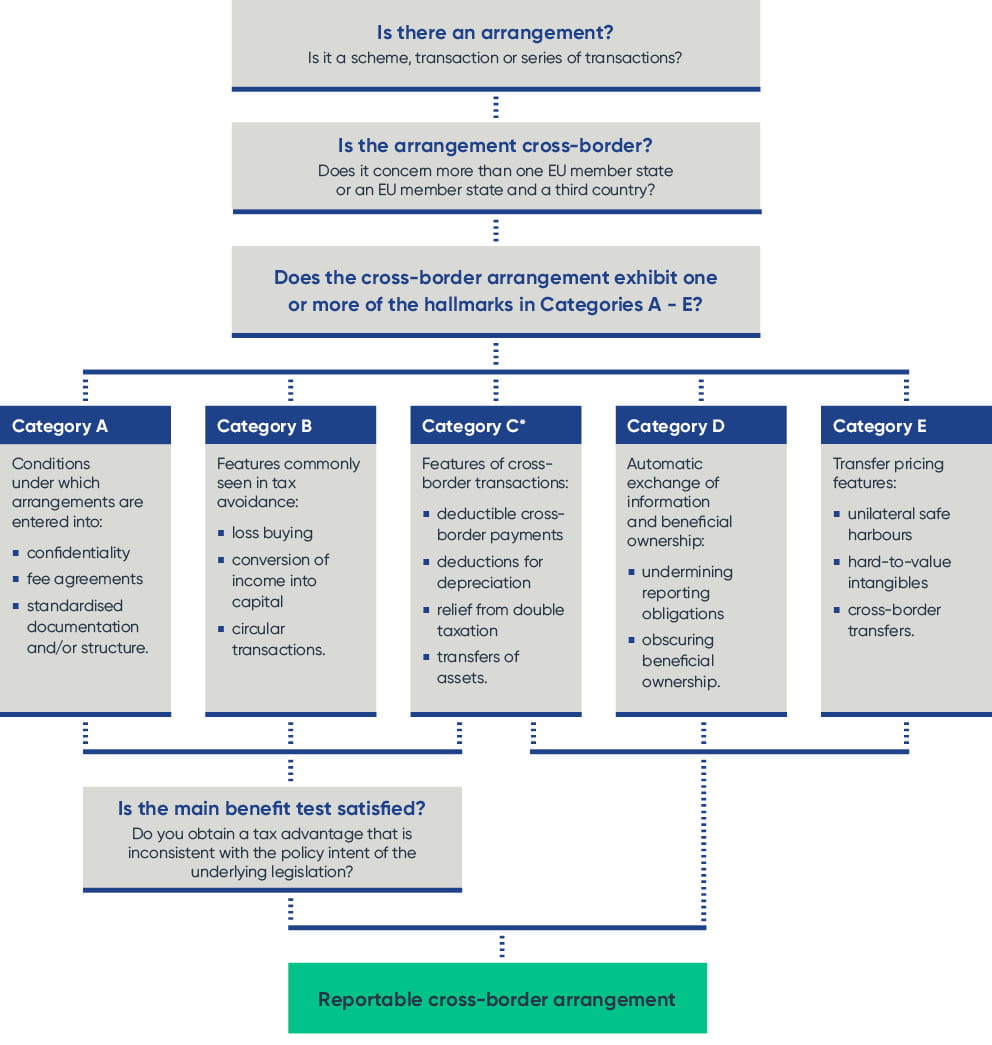

To be reportable, the cross-border arrangement must display one or more 'hallmarks' – features commonly seen in tax avoidance or evasion arrangements. Although certain hallmarks require a tax advantage to be obtained, some arrangements will be reportable despite having no tax motive.

The questions in the flowchart below will help determine whether there is a reportable cross-border arrangement:

* The only Category C hallmarks which require the main benefit test to be met are deductible cross-border payments where the recipient is tax resident in a low or zero corporate tax rate jurisdiction, or where the payment is exempt from tax, or benefits from a preferential tax regime, in the recipient's tax jurisdiction.

Where a cross-border arrangement is reportable, various details must be disclosed:

- identification of intermediaries and taxpayers

- details of relevant hallmarks

- summary of the arrangement

- date of the first step in implementation

- details of legislation that forms the basis of the arrangement

- value of the arrangement

- taxpayer's member state, and any other member states concerned by arrangement, and

- identification of any other person likely to be affected by the arrangement.

In the UK, the intermediary or taxpayer must report the above information via HMRC's online portal.

When is a cross-border arrangement reportable?

The reporting deadline for a cross-border arrangement is broadly determined by reference to its implementation date:

-

Historical arrangements implemented during the period 25 June 2018 - 30 June 2020 must be reported by 28 February 2021.

-

Arrangements implemented during the period 1 July 2020 - 31 December 2020 must be reported between 1 January 2021 - 30 January 2021.

-

From 1 January 2021 arrangements must be reported within 30 days of implementation (or certain other trigger events).

It is possible that these reporting deadlines may be delayed by three months because of COVID-19.

What are the penalties for non-compliance?

Failure to comply with reporting obligations under DAC 6 will generally incur a one-off penalty of up to £5,000. However, where this is deemed inappropriately low, a daily penalty of £600 may be imposed by the First Tier Tribunal for the duration of the failure, rising to a maximum of £1 million (in total) in exceptional cases.

How can we help?

There are several ways we can assist you regarding DAC 6:

-

As lawyers, legal professional privilege generally prevents us from reporting under DAC 6. However, should you be willing to waive privilege, we can disclose as intermediary any reportable cross-border arrangement on which we've advised. We have a detailed knowledge of the technical requirements of the DAC 6 regime and can provide a valuable insight into HMRC's practice and guidance. Combined with our understanding of all component parts of your transaction, we can control the content of the report and its presentation to HMRC.

-

Where we are not the only intermediary involved in an arrangement, we can liaise with your other advisers to ensure that any DAC 6 reporting obligations are fully complied with.

-

Should the reporting obligation fall on you, we can guide you through the disclosure process via HMRC's online portal.

-

We can provide an independent view as to whether DAC 6 applies to a particular arrangement.

Find out more

For a discussion of DAC 6 in the context of private holding structures, please also see our Summer 2020 Transparency Update.