- Home

- News & insights

- Insights

- Financial services m…

2023年4月6日

Financial services update – 33 / 72 观点

Financial services matters - April 2023

In this month's update:

- HMT and the regulators launch SMCR review.

- FCA publishes review of fast-growing firms.

- HMT publishes cryptoassets financial promotions legislation.

- Climate Financial Risk Forum publishes further guides.

- FCA sets out its priorities for payments firms.

- The regulators' response to SVB and Credit Suisse.

- FCA to collect economic crime levy from July 2023.

Review of the Senior Managers & Certification Regime

On 30 March 2023, the government and the regulators launched their review of the Senior Managers & Certification Regime as announced in the Edinburgh Reforms in December 2022.

A joint Discussion Paper (DP23/3) from the FCA and PRA looks at the effectiveness, scope and proportionality of the regime and should be read together with HMT's Call for Evidence, which looks at the legislative aspects of the regime. For further details, please see our article.

Update on Financial Services and Markets Bill 2022-23

On 23 March 2023, the Financial Services and Markets Bill 2022-23 (FSM Bill) completed its committee stage in the House of Lords.

This press release sets out the issues that were considered. A revised version of the FSM Bill has been published on the UK Parliament website; no major amendments have been made since the FSM Bill had its second reading in the House of Lords in January 2023 (please see our February 2023 update).

The FSM Bill will now move to the report stage for further scrutiny.

FCA launches new consumer section of its website

On 22 March 2023, the FCA launched a new consumer section of its website as a result of research into how and why consumers engage with the FCA, what the FCA can offer consumers and how the FCA can do better.

FCA publishes an update on operating service metrics for authorisation timelines

On 21 March 2023, the FCA published an update on its operating service metrics for authorisation timelines.

Performance metrics included in the update show two "red" areas which relate to authorisations and registrations for payment services and e-money. The FCA notes that it is seeing incomplete and poor-quality applications in this area. The update also shows that the FCA has significantly reduced the time to allocate and begin work on change in control notifications, with this now happening within three days of receipt on average.

Financial Ombudsman Service announces latest increase to its award limit

On 20 March 2023, the Financial Ombudsman Service (FOS) published a press release announcing that the FCA has confirmed the latest increase to its award limit.

The award limit is adjusted each year in line with inflation and represents the maximum amount the FOS can require a firm to pay when it upholds a complaint.

From 1 April 2023, the FOS's award limits will change to:

- £415,000 for complaints about acts or omissions by firms on or after 1 April 2019.

- £190,000 for complaints about acts or omissions by firms before 1 April 2019.

FCA findings from multi-firm review of fast-growing firms published

On 10 March 2023, the FCA published a webpage setting out the findings of its review of 25 fast-growing FCA solo-regulated firms. The review focused on contract for differences providers, wealth managers and payment services firms. However, the FCA highlighted that their observations are relevant to all regulated firms that have grown rapidly or have plans to do so.

The FCA found that for most firms:

- Risk management frameworks and governance arrangements have not kept pace with the growth in their business activities.

- Assessment of the adequacy of financial resources did not consider the growth in their underlying business.

- Wind-down plans were inadequate following fast growth.

The findings outlined above result in an increased risk of poor outcomes for consumers and an increased risk of harm in the event of firm failure.

The FCA expects all fast-growing firms to continually identify, assess and manage the risks arising from their activities and associated growth and to hold adequate financial and non-financial resources to cover such risks and mitigate potential harm.

It is recommended that all regulated firms that have grown rapidly or plan to do so should read the findings and consider whether their arrangements need to be amended.

FCA publishes updated perimeter report

On 6 March 2023, the FCA published an updated version of its webpage on the perimeter report.

The perimeter report sets out specific issues around the regulatory perimeter and the action the FCA is taking in response. The FCA last updated the perimeter report webpage in July 2022 (please see our August 2022 update).

Revisions include amendments to the sections of the report covering:

- Appointed representatives.

- ESG data and ratings providers.

- Funeral plans.

- BNPL products.

- Senior Managers and Certification Regime.

The FCA states that it intends to update the perimeter report regularly.

Crypto promotions legislation published

On 27 March 2023, a draft statutory instrument, the Financial Services and Markets Act 2000 (Financial Promotion) (Amendment) Order 2023, was published along with a draft explanatory memorandum. The new regime, which will be supported by FCA rules, is intended to enhance consumers’ understanding of the risks associated with cryptoasset investments and ensure that cryptoasset promotions have to meet the same standards as for other financial services. Please see our article for more detail.

EIOPA launches a digitalisation market monitoring survey

On 7 March 2023, the European Insurance and Occupational Pensions Authority (EIOPA) launched a digitalisation market monitoring survey to monitor the development of European insurers' digital transformation strategies and to help EIOPA better understand how innovative business models and technologies will be used.

EIOPA is aiming to keep pace with digitalisation developments and to ensure that insurance regulation and supervision reflect the opportunities and risks that digitalisation brings.

Government-backed national hub for fintech launched

At an event in Leeds on 28 February 2023, a national hub for fintech excellence was formally launched.

The Centre for Finance, Innovation and Technology (CFIT) will seek to boost the UK fintech sector's growth and help it to scale globally. The UK's fintech sector is dominant and is second globally only to the US for fintech investment.

CFIT is the first of its kind in the world and is backed by £5.5 million of funding.

Climate Financial Risk Forum publishes further guides

On 22 March 2023, the FCA updated its webpage on the Climate Financial Risk Forum (CFRF) to include further guides to assist the financial sector develop its approach to climate-related financial risks and opportunities. The guides are part of the output of Session 3 of the CFRF, which is due to conclude shortly (see our January 2023 update for details of the first batch of Session 3 guides, which were published in December 2022).

The latest materials focus on the transition to net zero, scenario analysis and climate disclosure, data and metrics:

- Disclosure, Data and Metrics – CFRF Climate Disclosures Dashboard.

- Disclosure, Data and Metrics – Webinar 1 – The limitations of portfolio climate data.

- Disclosure, Data and Metrics – Webinar 2 - Forward-looking portfolio climate metrics.

- Disclosure, Data and Metrics – Webinar 3 - Climate data coverage.

- Disclosure, Data and Metrics – Supporting content for Webinars.

- Scenario Analysis - Online climate scenario analysis narrative tool (updated version March 2023).

- Scenario Analysis - Asset Management Guide.

- Scenario Analysis - Learning from the 2021/22 Climate Biennial Exploratory Scenario (CBES).

FCA publishes Dear CEO letter on ESG benchmarks review

On 20 March 2023, the FCA published a Dear CEO letter sent to benchmark administrators setting out the findings of its preliminary ESG benchmarks review.

The review found that the quality of disclosures made by a sample of UK benchmark administrators was poor. The issues and risks identified included insufficient detail being provided on the ESG factors considered in benchmarking methodologies and not fully implementing ESG disclosure requirements.

In the letter, the FCA highlights that it expects all CEOs, senior leadership and boards to carefully consider the content of the letter in relation to their business and that benchmark administrators must ensure they have appropriate strategies to address the issues and risks identified. The FCA has stated that where firms fail to consider the FCA's feedback, the FCA will make use of its formal supervisory tools and will consider enforcement action where appropriate.

FCA publishes Primary Market Bulletin No. 44

On 20 March 2023, the FCA published Primary Market Bulletin No 44. The bulletin addresses, amongst other things, disclosure requirements relating to diversity and inclusion (D&I) on boards and executive management.

In the bulletin the FCA notes that in preparing D&I disclosures Listing Principle 1 extends to establishing and embedding D&I reporting procedures, systems and controls to meet obligations. The bulletin also sets out that the FCA will periodically review annual financial reports to determine whether listed companies are meeting D&I disclosure requirements and if such requirements are not met then the FCA may request corrective action, such as requiring the company to publish the required information via an RIS.

PRA publishes report on climate-related risks and capital frameworks for banks and insurers

On 13 March 2023, the PRA published a report on climate-related risks and the regulatory capital frameworks for banks and insurers.

The report sets out the Bank of England's latest thinking on climate-related risks and capital frameworks and includes updates on:

- Capability gaps and regime gaps.

- Capitalisation timelines.

- Areas for future research and analysis.

The Bank outlines that there remain many open questions including on potential regime gaps to capture systemic risks from climate change and unintended consequences. The Bank acknowledges that substantial further work is needed.

Treasury Sub-Committee asks FCA questions in relation to sustainability disclosure consultation paper

On 9 March 2023, the Treasury Sub-Committee on Financial Services Regulations sent a letter to the FCA's Chief Executive regarding the FCA's consultation paper on Sustainability Disclosure Requirements (SDR) and investment labels (for more information on the consultation paper, please see our November 2022 update).

The letter outlines the Committee's concern that the cost-benefit analysis supporting the consultation falls short on the basis that it does not include the potentially substantial costs to the consumer which would result from the measures, especially the costs associated with consumers transferring their assets out of funds accused of greenwashing and into sustainable funds.

The Committee asks the FCA to:

- Provide a new cost-benefit analysis estimating the monetary and other costs to consumers of its proposals.

- Explain how the FCA will pursue fund managers that have promoted misleading financial products with a view to providing redress for consumers.

The FCA was asked to provide responses by 23 March 2023.

The FCA's consultation on SDR and investment labels closed on 25 January 2023. In a press release published on 29 March 2023, the FCA commented that there is broad support for the proposed regime and the outcomes the FCA is seeking to achieve and it has received rich and constructive feedback on the detail of the proposals. The FCA is considering the feedback received and intends to publish the policy statement in Q3 2023.

European Commission requests ESAs, ECB and ESRB to conduct climate risk scenario analysis exercise

On 8 March 2023, the European Commission sent a letter concerning a climate risk analysis scenario exercise to the following authorities:

- The European Supervisory Authorities.

- The European Central Bank.

- The European Systemic Risk Board.

The letter also includes a formal mandate for the exercise.

The exercise will assess the resilience of the financial sector and the extent to which climate risks could generate stress for the financial system as a whole up to 2030.

The Commission calls on the authorities to launch the exercise as soon as possible, suggesting that it could be based on 2022 balance sheet data. The authorities are required to provide the Commission with the results of the exercise no later than Q1 2025, and ideally by the end of 2024.

Payment Systems Regulator publishes policy statement on measures to improve transparency on APP scam data

On 23 March 2023, the Payment Systems Regulator (PSR) published a policy statement on measures to improve transparency on authorised push payment scam data across banks and building societies following various consultations.

The PSR issued Specific Direction 18 requiring the 14 largest payment service provider (PSP) groups to collect and report on data on three metrics of performance of their management of APP scams. The PSR will publish the results of the 14 PSP groups on its website on a six-monthly basis. The PSR has published reporting guidance alongside the Specific Direction and will finalise publication formats ahead of publication to ensure the data accurately portrays patterns as they emerge when it is collected.

Lending Standards Board reviews and updates CRM code for APP scams

On 17 March 2023, the Lending Standards Board (LSB) published the March 2023 edition of its LSBulletin in which it refers to its review and update of sections of the contingent reimbursement model code (CRM code) for authorised push payment scams.

The LSB has published the updated version of the CRM code and in a related press release explained that the updates require signatory firms to go further in identifying accounts at a higher risk of being used by criminals. Firms must take certain steps outlined in the CRM code to stop the onward movement of funds they believe are linked to scams. The aim is that this will lead to more effective recovery of money lost by customers.

The LSBulletin also mentions that:

- The LSB's compliance team is engaged in an end-to-end review of the standards of lending practice for business customers and registered firms' adherence to them.

- The LSB is working on several reports on inclusion.

Payment Systems Regulator consults on proposed revised penalty statements

On 16 March 2023, the Payment Systems Regulator (PSR) published a consultation paper on proposed changes to its penalty statements.

Currently the PSR has three penalty statements. These statements set out the principles the PSR applies when determining penalties and exercising its associated powers of publication.

The PSR has reviewed the existing penalty statements and has considered feedback from stakeholders. As a result, the PSR proposes making the following changes:

- Combining the three penalty statements into one.

- Changing the way the PSR considers the duration of a compliance failure and how the PSR takes account of revenue when calculating penalties.

- Clarifying what the PSR means by "senior management".

- Adding further clarity to when the PSR consider a compliance failure is deliberate or reckless.

- Reinforcing the principle that penalties should disincentivise compliance failures.

The PSR has requested feedback on the proposals by 17:00 on 27 April 2023.

FCA publishes portfolio letter sent to payment firms

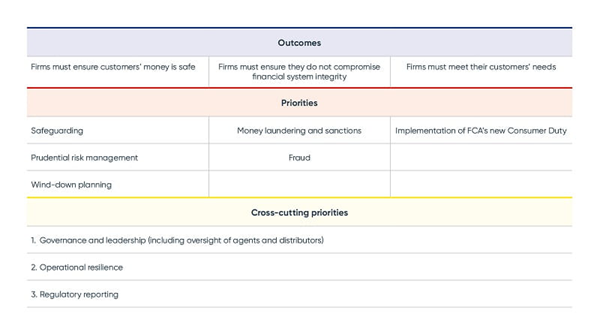

On 16 March 2023, the FCA published a portfolio letter sent to payment firms setting out the actions the FCA expects them to take. The FCA is concerned that many payments firms lack sufficiently robust controls, which means that some firms present an unacceptable risk of harm to their customers and to the integrity of the financial system.

The FCA has set out three outcomes it expects payment firms to deliver. In relation to each outcome, it has listed a number of priority action points as well as three "cross-cutting" priorities.

The FCA also states that it expects firms to take action to support the FCA's ESG agenda and that diversity and inclusion remains a core area of focus and invites firms to provide feedback and data which could help the FCA develop policy in this area.

Authorities conclude that the Memorandum of Understanding for payment systems in the UK is working well

On 8 March 2023, following the compulsory annual review and in line with feedback from industry, the Bank of England, FCA, PRA and Payment Systems Regulator concluded that the Memorandum of Understanding that sets out the high-level framework the authorities use to cooperate with one another in relation to payment systems in the UK is working well.

Treasury Committee publishes regulators' responses regarding proposed mandatory reimbursement for APP fraud

In February 2023, the House of Commons Treasury Committee published its report on the Payment Systems Regulator's (PSR) proposals to introduce mandatory reimbursement for authorised push payment scams and it also published the letters it sent to the regulators in January 2023 (please see our March 2023 update).

On 4 March 2023, the Committee published letters from the following regulators in response to the letters it sent:

- the PSR

- the Bank of England

- the FCA

- the Financial Ombudsman Service.

On 29 March 2023, the Committee published a response it received from the PSR to its report.

On 10 March 2023, the FCA published finalised guidance setting out the ways mortgage firms can support their existing mortgage borrowers impacted by the rising cost-of-living crisis.

The guidance aims to ensure that firms clearly understand the effect of the FCA's rules, guidance and principles and the range of options available to them to support their customers. In Annex 1 to the guidance, the FCA summarises and responds to the feedback it received in response to its consultation on the draft guidance (which we covered in our January 2023 update).

Alongside the guidance, the FCA has published a research note showing that in addition to the households already behind on payments, 356,000 mortgage borrowers could face payment difficulties by the end of June 2024. In the note the FCA highlights that it will continue to monitor the situation as it develops and is watching the data closely.

Treasury Committee requests information from FCA on competition in retail banking market

On 22 March 2023, the House of Commons Treasury Committee published a letter sent to the FCA about competition in the retail banking market.

The committee outlines that it would welcome further information from the FCA on what work it is doing to ensure there is effective competition in the markets for savings and mortgage products and that banks are not relying on consumer inertia to allow savings interest rates to rise at a slower pace than mortgage interest rates.

The Annex to the letter sets out a series of questions for the FCA relating to savings rates, mortgage products and the Consumer Duty. The Committee has asked the FCA to respond by 12 April 2023.

Banking supervision statements published relating to the UBS takeover of Credit Suisse

On 19 March 2023, the Swiss Financial Market Supervisory Authority published a press release providing details of the takeover of Credit Suisse by UBS.

In response:

- The FCA published a statement indicating it is minded to approve the actions announced as part of the takeover in relation to the entities that fall under its regulatory and supervisory remit.

- The Bank of England published a statement supporting the implementation of the takeover.

- The European Banking Authority, the Single Resolution Board and the European Central Bank published a joint statement welcoming the actions taken by Swiss authorities to ensure financial stability.

In relation to the approach taken to Credit Suisse's additional tier 1 (AT1) instruments in the takeover, the Bank of England published a subsequent statement re-iterating the statutory order in which shareholders and creditors bear losses in a resolution or insolvency scenario in the UK and that in line with this order in such a scenario the holders of AT1 instruments should expect to be exposed to losses.

PRA publishes consultation paper on the non-performing exposures capital deduction

On 14 March 2023, the PRA published a consultation paper on the non-performing exposures (NPE) capital deduction.

One of the PRA's proposals is to remove the Common Equity Tier 1 deduction requirement in its Rulebook for NPE that are treated as insufficiently covered by firms' accounting provisions. The PRA considers that this would enhance the definition of capital in a way that aligns with international standards and would increase the scope for the PRA to take a judgement-led approach to the prudential risks associated with NPE.

The PRA is also proposing to remove the associated reporting requirements for the NPE deduction and is consulting on amending the associated reporting templates. Removing the associated reporting requirements will reduce firms' monitoring, compliance and data gathering costs.

Comments can be made on the proposals until 14 June 2023. It is anticipated the changes would come into force for the fourth quarter of 2023.

Bank of England statement on resolution of Silicon Valley Bank UK and publication of The Amendments of the Law (Resolution of Silicon Valley Bank UK Limited) Order 2023

On 13 March 2023, the Bank of England published a statement on the resolution of Silicon Valley Bank UK Ltd (SVBUK).

The Bank and the PRA decided that the deterioration of liquidity and confidence in SVBUK meant that it was appropriate to use the transfer to a private sector purchaser stabilisation tool under the Special Resolution Regime to sell SVBUK to HSBC UK Bank plc.

The private sector purchaser stabilisation tool involves the transfer of all, or part, of a bank's business to a willing and appropriately authorised private sector purchaser without the need for consent of the failed bank, its shareholders, customer or counterparties.

On the same date, an order made in connection with the resolution of SVBUK came into force. The order has the following effects:

- Removing the requirement for transactions to take place at arms-length, enabling the provision of liquidity from HSBC UK Bank plc which would otherwise not have been permitted under the ring-fencing regime.

- Modifying certain rule-making powers in the Financial Services and Markets Act 2000 (FSMA) so that they are exercisable by the PRA and the FCA in connection with the SVB transaction.

- Modifying certain duties of the FCA and the PRA under FSMA to consult on rule changes.

An explanatory memorandum was provided in connection with the order.

House of Commons Treasury Committee publishes an exchange of letters with Bank of England Governor

On 6 March 2023, the Treasury Committee published an exchange of letters with Andrew Bailey, Bank of England Governor.

The exchange covers:

- A letter sent by the Committee on 23 January 2023 to Mr Bailey listing the matters on which he had agreed to provide further information.

- A letter sent by Mr Bailey on 22 February 2023 to the Committee responding to the matters raised, including the potential impact of the government's UK Solvency II reforms on the probability of failure in insurance companies and the potential public cost.

The current Solvency II Regime is calibrated to ensure insurers hold sufficient capital to withstand a stress level with 99.5% probability over a one-year period. This equates to a solvency standard equivalent to an annual probability failure of 0.5%. The Bank considers that, over a one-year period, it is likely the impact of the government's reforms could lead to an increase in the annual probability of failure for the life insurance sector to approximately 0.6%.

In his letter, Mr Bailey considers the scale of the potential cost of any increase in the probability of failure on the Financial Services Compensation Scheme and public funds and outlines potential mitigants. Mr Bailey also responds to the Committee's question on potential reforms to the senior managers and certification regime and the ring-fencing regime.

HM Treasury publishes a call for evidence on aligning the bank ring-fencing and resolution regimes

On 2 March 2023, HM Treasury published a call for evidence on aligning the bank ring-fencing and resolution regimes. The focus of the call for evidence is on the ring-fencing regime and the Treasury is not seeking views on changes to the resolution regime.

The call for evidence follows a recommendation that HM Treasury should review the practicalities of how to align the ring-fencing and resolution regimes on the basis that both regimes address the issue of "too big to fail".

The Treasury states that there are three options for future alignment:

- Retaining the existing regimes.

- Disapplying the ring-fencing regime from some or all in-scope firms.

- Revising elements of the ring-fencing regime that do not provide material benefits.

Among other things, HM Treasury seeks views on the long-term future of the ring-fencing regime, the benefits of ring-fencing to resolution and the practical implications of those benefits and the costs associated with the modified ring-fencing regime.

The deadline for responses is 7 May 2023.

HM Treasury and FCA complete review of criminal market abuse regime

On 24 March 2023, HM Treasury and the FCA published a joint statement on the review of the criminal market abuse regime.

The review identified a number of areas where the government believes it would be appropriate to update the criminal regime, as the regime has not been materially updated since it was introduced. The statement did not provide details of these areas.

The statement also sets out that the government will consider changes to the criminal regime alongside any reforms to the retained EU law version of the Market Abuse Regulation through the Future Regulatory Framework Review.

FCA publishes speech on proposed simplified advice regime and advice/guidance boundary review

On 21 March 2023, the FCA published a speech by the FCA Director of Consumer Investments on the FCA's proposed simplified advice regime and its wider financial advice/guidance boundary review.

Points of interest include that generally firms support the premise of the FCA's proposals on a core investment advice regime, that the FCA are evaluating responses to the future disclosure framework consultation and discussion of certain elements of the consumer duty. The FCA also confirmed the scope of and approach to the financial advice/guidance boundary review.

ESMA raises concerns about proposed changes to the Market Abuse Regulation insider list regime

On 20 March 2023, the European Securities and Markets Authority (ESMA) published a letter it sent to the European Parliament and the Counsel of the European Union raising concerns about proposed changes to the Market Abuse Regulation (MAR).

ESMA is concerned about the amendments to Article 18 of MAR proposed by the European Commission. Under these changes an issuer's insider list would no longer be event-based and would only need to include permanent insiders (being those persons that have regular access to inside information).

HM Treasury announces terms of reference for Investment Research Review

On 9 March 2023, HM Treasury published the terms of reference for the Investment Research Review and announced the appointment of Rachel Kent as Chair of the Review.

The Review has been launched in response to concerns about the quality and quantity of investment research produced in the UK and has two key objectives:

- To assess the link between levels of research and the attractiveness of the UK as a destination to list.

- To evaluate options to improve the UK market for investment research and provide recommendations to this effect.

The Review started on 13 March 2023 and is required to report within three months.

ESMA updates Q&A on Crowdfunding Regulation

On 8 March 2023, the European Securities and Markets Authority (ESMA) published an updated version of its Q&As relating to the Regulation on European crowdfunding services providers for business (ECSPR).

ESMA last updated the Q&As in December 2022 and in the most recent update have added a new Q&A relating to payment services performed under Article 10 of the ECSPR.

ECON reports on proposed amendments to MiFIR and MiFID II Directive published

On 8 March 2023, ECON published the report it has adopted on the proposed regulation amending the Markets in Financial Instruments Regulation.

On 3 March 2023, the European Parliament's Economic and Monetary Affairs Committee (ECON) published the report it has adopted on the proposed directive amending the MiFID II Directive.

FCA publishes findings of trade data review and launches wholesale data market study

On 2 March 2023, the FCA published a report on its review of trade data and announced the launch of its wholesale data market study.

In March 2020, the FCA issued a call for input on issues relating to access to and use of wholesale data. Responses to the call for input confirmed the FCA's concerns that firms that generate data for wholesale financial markets may be able to use or market their data in ways that create poor outcomes for users and end-consumers.

Accordingly, in June 2022 the FCA launched a trade data review to address concerns that a low level of competition was leading to a level and structure of data charges that increased costs, affected investment decisions and limited the efficiency of trading.

The findings report for the FCA's trade data review suggests that, while trade data users can generally access the data they need, there are areas where the market does not currently work as effectively as it could in allowing effective competition and innovation.

The FCA has identified the following main areas of concern, among others:

- The scope for competition is limited, leading to high prices.

- High prices for trade data are likely to feed through to higher costs of business in wholesale financial markets in the UK.

- Venues charge some users more depending on their data needs.

- Complicated licensing makes it difficult for users to monitor trade data costs and make effective choices.

- Users find free delayed data is often of poor quality.

In terms of next steps, the FCA will consult by the summer of 2023 on proposals for consolidated tapes. A consolidated tape collects wholesale data across the market and distributes them in single, standardised data feeds. The FCA's wholesale data market study will allow it to look in more depth at the impact market data vendors have on wholesale data markets and outcomes. The report is expected to be published by 1 March 2024.

Council of the EU publishes information note on trialogue negotiating positions of EU institutions on proposed Directive amending AIFMD and UCITS Directive

On 28 March 2023, the Council of the EU published an information note containing a table comparing the negotiating positions taken by the European Commission, the Council of the EU and the European Parliament on the proposed Directive amending the Alternative Investment Fund Managers Directive and the UCITS Directive.

The note has been published as trialogue negotiations on the legislation take place.

ESMA publishes updated versions of Q&As on application of AIFMS and EuSEF and EuVECA

On 10 March 2023, the European Securities and Markets Authority published updated versions of two Q&A documents:

- Q&A on the application of the Alternative Investment Fund Managers Directive – including a new section on exemptions.

- Q&A on the application of the European Social Entrepreneurship Funds Regulation and the European Venture Capital Funds Regulation – including a new question on investment in another qualifying venture capital fund/qualifying social entrepreneurship fund.

FCA authorises first long-term asset fund

On 9 March 2023, the FCA published a press release announcing the authorisation of the first long-term asset fund (LTAF).

LTAFs are a new category of open-ended authorised fund designed to facilitate investment in long-term illiquid assets, particularly by defined contribution pension schemes.

The FCA published a consultation paper on broadening retail access to LTAFs in August 2022 (please see our September 2022 update). The consultation closed on 10 October 2022, and the final policy statement and rules are anticipated in the first half of this year.

Regulation amending ELTIF Regulation to enter into force on 9 April 2023

On 7 March 2023, the Council of the EU published a press release announcing its adoption of the proposed Regulation amending the Regulation on European long-term investment funds (ELTIF). The amendments relate to the investment policies and operating conditions of ELTIFs and the scope of eligible investment assets, the portfolio composition and diversification requirements and the borrowing of cash and other fund rules.

The re-designed regulatory framework will make these types of investment funds more attractive and easier to invest in. ELTIFs are designed to channel long-term investments and are therefore well placed to help finance the green and digital transitions.

On 20 March 2023, the amending Regulation was published in the Official Journal of the European Union. Accordingly, the amending Regulation will enter into force on 9 April 2023 and will apply from 10 January 2024.

Existing ELTIFs will be deemed to comply with the amending Regulation for five years. ELTIFs that do not raise additional capital will also be deemed to comply with the amending Regulation.

Update on regulatory response to the London Metal Exchange and LME Clear following suspension of nickel trading

On 3 March 2023, the FCA published a statement concerning supervisory action that it has taken in relation to the London Metal Exchange (LME) following LME's decision to suspend trading on its nickel market on 8 March 2022. The Bank of England published an equivalent statement on its supervisory action relating to LME Clear. LME suspended trading on the nickel market after concluding that a disorderly market had arisen because of difficult commodity market conditions as a result of the conflict between Russia and Ukraine.

The FCA states that it has started an enforcement investigation into some of LME's conduct and systems and controls that were in place in the period between 1 January 2022 and the time of suspension on 8 March 2022. The FCA will not make any further comment on the investigation.

The Bank states that the external review of LME Clear and the Bank's own review of its operation highlight shortcomings concerning LME Clear's governance, management and risk management capabilities. The Bank will appoint a skilled person to monitor, assess and report to it regularly on LME Clear's implementation progress against remedial actions. It will incorporate those reports into its supervisory strategy for LME Clear.

FCA investigates potential unregistered crypto ATMs in East London

In March 2023, the FCA reported that in a joint operation with the Metropolitan Police it had inspected several sites in East London suspected of hosting illegally operating crypto ATMs.

In February 2023 similar action was taken in Leeds, suggesting the FCA is cracking down on the illicit sector. Crypto ATMs allow people to buy or convert money into cryptoassets. There are currently no crypto ATM operators registered with the FCA, which they must be to operate legally.

The FCA will review evidence gathered during these visits and will take further action where necessary.

Financial Action Task Force updates material on transparency and beneficial ownership of legal arrangements and persons

On 10 March 2023, the Financial Action Task Force (FATF) published:

- Updated guidance on recommendation 24 on the transparency and beneficial ownership of legal persons.

- A revised version of the FATF recommendations to reflect revisions to recommendation 25 on the transparency and beneficial ownership of legal arrangements and its interpretive note.

The updated guidance aims to assist policy makers and practitioners in national authorities and private sector stakeholders implement the necessary measures so that shell companies can no longer be a safe haven for illicit proceeds with links to crime or terrorism. It is intended to help countries identify, design and implement appropriate measures to ensure that beneficial ownership information is held by a public authority and assess and mitigate the money laundering and terrorist financing risks associated with foreign companies to which their countries are exposed.

FCA to collect Treasury's economic crime levy from July

On 9 March 2023, the FCA announced that from July 2023 it will collect an economic crime levy to fund the fight against economic crime.

The levy will apply to businesses which were subject to the money laundering regulations between 6 April 2022 and 5 April 2023, including:

- Credit institutions.

- Financial institutions.

- Auditors and tax advisers.

- Independent legal professionals.

- Estate and lettings agents.

- Crypto asset exchange providers and custodian wallet providers.

- Trust or company service providers.

The levy will appear on FCA invoices from July 2023 and will be paid annually. The levy will be determined by a firm's UK revenue.

All impacted firms must submit their data via new Reg Data Report (FIN074) from 1 April to ensure firms are charged the right amount. A failure to submit in time may result in a £250 administrative fee.

Joint Money Laundering Steering Group finalises revisions to Part II of AML and CTF guidance

On 6 March 2023, the Joint Money Laundering Steering Group (JMLSG) published a press release announcing the publication of revisions to Part II of its anti-money laundering (AML) and counter-terrorist financing (CTF) guidance for the financial services sector. The finalised revisions relate to wealth management, financial advisers, consumer credit providers, private equity and crypto asset exchange providers and custodian wallet providers.

On 17 March 2023, JMLSG published a press release announcing the publication of further revisions to Part II of its AML and CTF guidance for the financial services sector. The finalised further revisions relate to non-life providers of investment fund products and discretionary and advisory investment management.

The JMLSG has submitted the revisions to HM Treasury for ministerial approval.

The answer to last month's question: 3 of the 7 specific directions issued by the Payment Systems Regulator in 2022 related to Confirmation of Payee.

According to the FCA’s latest Perimeter Report, what was the top root cause for operational incidents reported to the FCA between 2020 and 2022?

- Human error.

- Cyber attack.

- Hardware/software.

- 3rd party failure.