- Home

- News & insights

- Insights

- Markets of the metav…

2023年2月2日

Article series

Markets of the metaverse – Part III

- In-depth analysis

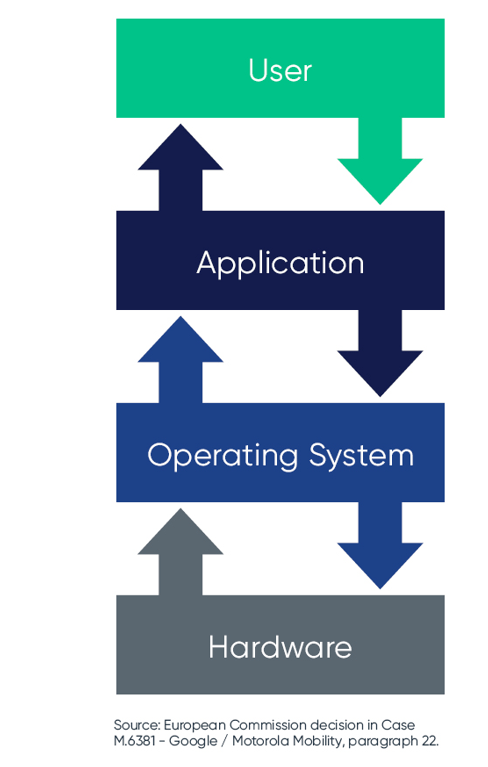

In our last post, we delved into the operating systems (OS) of the metaverse that are vital to the functioning of the virtual reality. If you missed that post, you can find it here.

After tackling with the hardware and the operating systems, we now want to move up one level today and touch upon with the markets of the app stores of the metaverse.

We have to take into account two different perspectives when defining the markets for app stores: The OEMs of smart devices, which can choose between different app stores for their devices on the one hand and developers and end users on the other hand. In this article, we want to focus on the OEM perspective. In the next article we will have a look at the developers and end users.

When examining the app store markets from an OEM perspective, we can continue sticking with the considerations of the European Commission's decision in the Android case (Case AT.40099 - Google Android), as we had done in our last post. As regards the different tools to define the relevant markets, see our first article.

Let's dive in!

1. What are app stores?

Most of you (if not all of you) will already know what app stores are.

The European Commission defines app stores as "digital distribution platforms, constituted by online services and related apps that are dedicated to enabling users to download, install and manage a wide range of diverse apps from a single point in the interface of the smartphone" (Case AT.40099 para 86).

For us users, app stores are generally free of charge; we only have to pay for some of the apps in the stores. According to unconfirmed reports, OEMs have to pay up to EUR 40 per device for services such as the Google Play Store.

And of course, the metaverse has its own app stores, too. To be more precise: VR headsets support app stores for the metaverse. For example, Meta offers its Oculus Quest Store with over 400 apps, of which more than 120 have a turnover of more than USD 1 million. In other words, up to this point, VR headsets app stores differentiate very little from the smart mobile devices we know.

2. Product market of app stores for the metaverse

Let´s see how the European Commission defines the markets for app stores from an OEM perspective in its Android decision (a.) and what we can learn from that for the market of app stores for the metaverse (b.):

a. Market definition of the European Commission of app stores for smart mobile devices

First, the European Commission distinguishes markets for app stores for PCs from those for mobile devices (Case AT.40099 footnote 38). Because app stores for PCs are built to allow users to download software for PCs and not for smart mobile devices, they do not belong to the same product market as app stores for smart mobile devices. So far so good.

Second, the European Commission examines the markets for app stores in the smart mobile sector.

- With regard to smart mobile devices, the European Commission distinguishes first between apps and the actual app stores.

App stores, from a demand-side perspective, primarily serve as distribution channels. Therefore, apps and app stores have different areas of application. As a result, app stores cannot be substituted by single apps (Case AT.40099 para 271) (What should be obvious from our point of view).

From a supply-side perspective, the development of an app store takes much longer and requires considerably more resources than that which a single app (usually) requires. This is true regardless of whether a developer has already programmed multiple apps. As a consequence, there is almost no supply-side substitutability (Case AT.40099 para 272). - In a next step, the European Commission examines the market definition with regard to various app stores for Android devices.

This is important not least because operating systems (OS) for VR headsets are currently often based on Android (see below).

First, the European Commission examines the demand-side substitutability from the perspective of the OEMs who produce mobile devices. OEMs of Android devices can choose between several app stores for their devices, such as the Google Play Store, the Galaxy Store or the Amazon Appstore. It comes to the conclusion that from the OEMs’ point of view different kinds of app store are, in part, substitutable. However, since the Google Play Store is by far the largest, it could be argued that all other app stores for Android only complement the Play Store, but do not replace it (see also Case AT.40099 para 277).

Second, from a supply-side perspective, developers might not be able to replicate the Google Play Store with its market power.

However, the other app stores for Android seem to be substitutable with each other. - In a final step, the European Commission distinguishes between app stores for other licensable smart mobile OSs and Android app stores as well as app stores for non-licensable smart mobile OSs and Android app stores (if these terms don't ring a bell, you might read our article on the OSs again).

- The latter is clear: If the OSs, such as iOS and Android, are not substitutable with each other, this must apply all the more to the app stores that run under the respective OSs. Apple’s iOS app store cannot be installed anywhere outside the iPhone ecosystem; Android app stores certainly do not run on an iPhone.

- The first point is, however, a bit more complex than that: In the end, the European Commission assumes that app stores for other licensable smart mobile OSs are not substitutable with app stores for Android devices.

From a demand-side perspective (OEMs, not the end users or app developers), app stores that are not programmed for Android are not installable on Android devices, even if the OS is licensable (Case AT.40099 para 285). OEMs cannot easily switch to other app stores, as they would have to change the OS of their devices first. The prices of apps sold via app stores are very low when compared to the costs of changing the OS for OEMs (Case AT.40099 para 287). App sales would therefore have to increase significantly when using a different app store, before an OEM would consider switching.

Additionally, there is almost no supply-side substitutability from the perspective of developers of app stores for other licensable OS, because the development of an app store for a given OS requires a lot of resources. According to the European Commission, this can be seen from the fact that "Microsoft, the largest developer of an app store for a non-Android licensable smart mobile OS", has not even considered to offer an app store for Android (Case AT.40099 para 295).

b. Consequences for app stores for the metaverse

What can we learn from that decision for the markets for app stores for the metaverse from an OEM’s perspective?

- First, app stores for the virtual reality are not substitutable with app stores for PCs.

- Second, VR apps are not substitutable with the app stores on VR-headsets.

- Last, it is not clear whether OEMs of VR headsets have the option to choose between different app stores, comparable to the situation of OEMs of smart mobiles with licensable OS.

The Meta Quest app store, for example, currently only runs on Meta Quest headsets and not on any other VR headset. We assume that most OEM have their own (non-licensable) app store. With a view to the arguments of the European Commission above, all these app stores are comparable to non-licensable app stores for smart mobiles. As a result, these apps stores would belong to different product markets.

In case that an OEM of VR headsets decides to license its app store (and OS) and make it available to other OEMs, this app store might compete with other licensable app stores, comparable to the competitive relationship between the Galaxy Store or the Amazon Appstore. However, we do not know if there are any licensable OS and app stores for VR headsets today.

It seem likely that the situation for OEMs of VR headsets will be comparable to the situation of OEMs for smart mobiles within the next years.

3. Geographic market of app stores for the metaverse

The markets of app stores are, comparable to the markets for OS, worldwide in geographic scope.

There are essentially no hurdles to offer app stores worldwide. App stores, as well as OSs, are available worldwide. Additionally, from a supply-side perspective, programming languages are, without exception, identical in all countries. There is no (relevant) local programming language. Only language barriers may pose as a difficulty. The European Commission also sees few language barriers (Case AT.40099 para 414).

OEMs in China, however, have developed their own app stores for smart mobiles. The top five app stores in China were in 2018: Myapp, 360 Mobile Assistant, Baido Mobile Assistant, MIUI app store and Wandoujia, which are all not successful outside of China (Case AT.40099 para 418). The European Commission states that those OEMs that pre-install Chinese app stores on devices sold in China, pre-install the Google Play Store on all other devices sold in the rest of the world (Case AT.40099 para 420). However, one of the biggest competitors of the Meta Quest headsets is the Pico headset, developed by the Chinese company ByteDance (TikTok). Pico headsets have an own app store (Pico VR Store), which seems to be identical for all users, regardless of their location. As a result, the situation for app stores for VR headsets could be different to app stores for other smart mobiles, but we have to track future developments on these markets.

4. Outlook

The European Commission's decision was largely upheld by the General Court of the European Union (Case T-604/18), in particular with a view to the market definition of app stores (Case T-604/18, para 235). Google has appealed against the decision. We will keep you updated on the ruling, as far as it relevant for market definitions for the metaverse.

Another interesting point regarding app stores could be the Digital Markets Act, which comes into force in the middle of this year. Art. 6 (1) c) Digital Markets Act could result in having Gatekeepers to open app stores (and their OS) to third parties, if these are qualified as core platform service. Whether this provision will apply to Meta and other OEMs of VR headsets with regard to their app stores remains to be seen in the future.

We will deal with the DMA in a later article of our blog. If you would like to read something about the Digital Markets Act today, you can find a good summary here.

本系列内容

Meta Quest – The competition law battle for the gate to the metaverse

The world is meeting up in the metaverse, only Germany isn’t there yet?

2022年12月15日

Related Insights

Markets of the metaverse – Part II

Markets of OS for virtual reality headsets

Markets of the metaverse - Part I

Markets of virtual reality headsets