- Home

- News & insights

- Insights

- The Vifo Act

- On this page

4 January 2024

The Vifo Act

- Briefing

In 2021, the High Tech Campus in Eindhoven, known as the “smartest square meters in the Netherlands”, was acquired by a Singapore sovereign wealth fund. Despite efforts by ‘local’ companies and the municipality of Eindhoven to keep this Dutch gem under national ownership, the transaction could not be blocked due to the lack of legal grounds to do so. This event underscores a broader concern regarding investments in vital providers, sensitive technology, and business campuses.

To maintain better control over such transactions, the Dutch general foreign direct investment (“FDI”) screening mechanism, known as the Investments, Mergers and Acquisitions Security Screening Act (in Dutch: Wet veiligheidstoets investeringen, fusies en overnames, the “Vifo Act”), came into effect on June 1, 2023. The Act, which has retroactive effect from September 8, 2020, encompasses transactions from that date onwards. The Vifo Act introduces an investment screening mechanism designed to identify investment activities that may pose risks to national security and public order, particularly those involving vital providers, business campus managers, or companies engaged in (highly) sensitive technology. This legal update will discuss the key elements of the Vifo Act.

Background

In March 2019, the EU adopted the Foreign Direct Investments Regulation (“FDI Regulation”) due to concerns about foreign investors, particularly state-owned enterprises, potentially acquiring vital assets and key technologies from European companies. The FDI Regulation establishes minimum standards for Member States' FDI screening mechanisms. However, the actual executive powers with regards to FDI screening remains primarily a national competence.

Acting on the FDI Regulation, the Dutch legislator enacted the Vifo Act. The Vifo Act acknowledges Europe's open investment climate, recognizing its benefits and associated risks. It outlines clear criteria for reporting obligations, assessment criteria, and possible measures.

Scope

The Vifo Act encompasses a broad range of acquisition activities as it applies to various types of investments such as direct investments, mergers, demergers, the creation of joint ventures, the acquisition of assets, and even asset components. A key aspect of the Vifo Act is its focus on situations where these investments result in obtaining control or significant influence over a target company which de facto conducts business in the Netherlands and which falls into one of the following categories:

- a vital provider;

e.g. heat transport, air transport (Schiphol), nuclear power, port area, gas storage, extractable energy, banking, companies that operate as a bank and companies involved in the financial sector infrastructure

- managers of corporate campuses;

e.g. managers of the High Tech Campus Eindhoven

- companies active in the area of (highly) sensitive technologies

This category includes dual-use products, military goods, quantum technology, semiconductor technology, high assurance products and photonics technology.

Control

Ultimately, the term ‘control’ is defined similarly to its usage in competition law, typically inferred when an acquisition of at least 50% of the voting rights occurs. However, for target companies that possess highly sensitive technology, the concept of 'significant influence' applies at lower thresholds. In these cases, acquiring either 10%, 20%, or 25% of the voting rights, depending on the specific nature of the highly sensitive technology involved, may be sufficient to constitute significant influence.

To summarize, from the above we can distil three cumulative requirements that could necessitate a notification obligation under the Vifo Act. These are as follows:

- an acquirer/investor acquires some degree of control or influence over the target company;

- the target company must de facto conduct its business in the Netherlands; and

- the target company can be qualified as a vital provider, manager of a corporate campus or company active in the area of (highly) sensitive technologies.

Formal Filing

If the cumulative requirements of the Vifo Act are fulfilled, the transaction is subject to a formal filing with the Bureau Toetsing en Investeringen (the Assessment and Investments Agency, “BTI”), which is part of the Ministry of Economic Affairs and Climate Policy. If the envisaged investment falls within the screening regime's scope, a notification would have to be made by either the acquirer or the target company. Even if the acquirer seems to be the most appropriate party to handle the notification, the target undertaking could in some cases be bound to observe non-disclosure obligations and would thus be the only appropriate entity to assess whether the transaction falls within the Vifo screening regime.

Filing

Transactions that fall under the Vifo Act have a notification requirement and may not be closed until the BTI has given approval. Until then, a standstill obligation applies. The filing is submitted to the BTI on the basis of a notification form. The notification form, which companies must use to report their transaction to the BTI, is attached to the Decree on security screening of investments, mergers and acquisitions (only available in Dutch) and may be altered from time to time.

BTI’s review proceeds in two phases: the screening phase and the review phase. Upon receiving a notification, the Minister will initially conduct a high-level screening to determine if there is a risk to national security and whether a review phase is necessary. In this initial screening the Minister can decide that the transaction is permitted, or if the initial screening indicates that further review is required and the transaction's risk to national security must further be further investigated. With regards to its assessment of the threat to national security, the BTI specifically looks at whether:

- the transaction leads to a disruption of the continuity of vital processes;

- the preservation of the integrity and exclusivity of knowledge and information with critical or strategic significance for the Netherlands is at risk; and

- the transaction leads to unwanted strategic dependence of the Netherlands on other countries.

Timeline

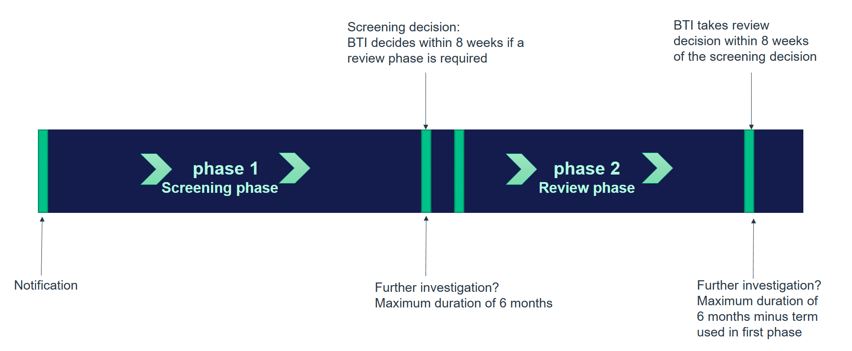

The timeline of the notification process with the BTI can be visualized as follows:

The BTI renders a decision in the screening phase within eight weeks. If additional investigation is required, this deadline can be extended by up to six months. The review phase is also subject to an eight-week decision period. That period can also be extended by up to six months. Nevertheless, the period for additional investigation during the screening phase is deducted from that maximum period. Hereby it must be noted that the clock stops if the Minister requests further information from the involved parties during the screening phase or the review phase. An extension by another three months is possible if an investor is established outside the EU and the investment falls under the EU FDI Regulation thresholds.

Possible Outcomes

The BTI may impose certain requirements or conditions to prevent or mitigate risks to national security. At the extreme, if the risks to national security cannot be removed through mitigating measures an acquisition activity can be outright prohibited.

Should an acquisition activity be prohibited, any action to carry out such transaction is rendered null and void. If, despite the prohibition, the transaction is executed, the offending party may face high fines, which can amount up to 10% of the turnover. Moreover, the BTI has the authority to divest the acquired interest from the shareholders and sell them to a third party, or take other necessary actions in alignment with the imposed requirements, acting on behalf of and for the account of the acquirer or target company. The proceeds, if any, must be provided for the benefit of the acquirer.

In exceptional circumstances, the Minister can reassess a concluded transaction, even after having previously issued a positive decision. A reassessment can only be conducted if there is a threat of a serious national security risk in the form of either a potential social disruption with economic, social or physical consequences, or a direct, increased and real threat to Dutch sovereignty. A reassessment can be ordered by the Minister no later than six months after becoming aware of the risk.

Related Insights

The European Accessibility Act: a ‘win-win’ piece of regulation

by Nick Strous