One of the key recommendations of HM Treasury's UK Secondary Capital Raising Review (our summary of which can be found here) was to allow premium-listed issuers to issue up to 20% of their issued share capital under their annual pre-emption right disapplication authority. 10% of that authority is intended to be available for any purpose, with a further 10% specifically for the purposes of an acquisition or a specified capital investment.

To implement this recommendation, the Pre-Emption Group (PEG) issued revised guidelines and template resolutions in November 2022, which can be found on the FRC's website. Whilst the revised PEG guidelines are primarily targeted at premium-listed issuers, companies with a standard or AIM listing are also encouraged to follow these.

In addition, the Investment Association (IA) issued updated Share Capital Management Guidelines in February 2023, which can be found here. The IA updated its previous guidance to reflect the recommendations made by HM Treasury, enabling issuers to seek annual allotment and pre-emption rights disapplication authorities of up to two thirds of their issued share capital, for all forms of fully pre-emptive offers and not just rights issues.

Summary of the new guidelines

The new PEG guidelines provide that a premium-listed issuer may seek authority by special resolution to issue non-pre-emptively for cash equity securities representing:

- up to 10% of their issued ordinary share capital for any purpose (with a further authority of up to 2% to be used for the purposes of making a "follow-on" offer)

A follow-on offer should be:

- made to qualifying shareholders at an agreed record date, excluding any shareholders allocated shares in the initial placing

- subject to an individual monetary cap per qualifying shareholder of not more than £30,000

The PEG guidelines also state that companies seeking to raise larger amounts, for example, fast growth technology or life sciences companies, should be able to seek a greater disapplication authority for general use, provided that the reasons for this are expressly disclosed to investors.

The previous guidelines issued by PEG stated that premium listed companies could disapply up to 5% of their issued ordinary share capital for any purpose, with up to an additional 5% in connection with a specified capital investment. Such authorities were subject to a rolling three year 7.5% limit on the use of the disapplication for general purposes.

In addition, the IA has updated its Share Capital Management Guidelines to widen the annual allotment and pre-emption rights disapplication authorities sought by issuers for up to two-thirds of their issued share capital to cover all forms of fully pre-emptive offers, rather than just rights issues.

Analysis: to what extent have listed tech and life sciences companies adopted the new PEG and IA guidelines?

As of 25 July 2023, 169 of the UK-incorporated technology and life sciences companies listed on the Main Market and AIM have published their AGM notices. We reviewed each of these AGM notices to assess the extent to which these companies have adopted the guidance set out in the revised PEG and IA Guidelines.

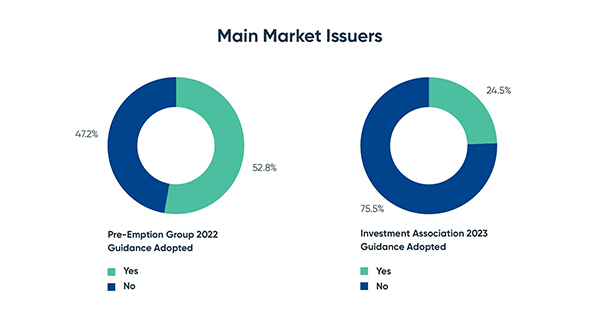

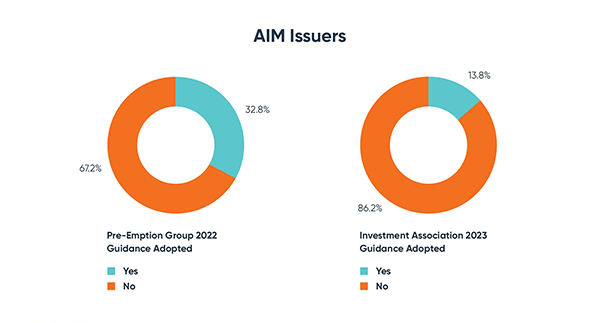

Of those issuers included in the sample that are listed on the Main Market, we found that:

- 53% have adopted the new 10% + 10% annual pre-emption right disapplication authority set out in the PEG guidelines

Of those issuers included in the sample that are listed on AIM, we found that:

- 33% have adopted the new 10% + 10% annual pre-emption right disapplication authority set out in the PEG guidelines

Conclusion

As can be seen, the adoption of the new guidance issued by the PEG and the IA has been relatively strong among both Main Market and AIM-listed issuers, though adoption by AIM companies is noticeably lower.

The timing of the publication of the guidance by PEG in November 2022 was helpful, providing issuers with sufficient time to consider the new principles and incorporate these into their AGM notices. Given that the new IA guidelines were only published in February 2022, the level of take-up is promising. The discrepancy between Main Market and AIM-listed issuers may be due to the fact that the PEG guidelines are specifically targeted at premium listed issuers on the Main Market, meaning that AIM companies may not be as motivated to readily adopt the guidance. We also observed that AIM companies were more likely to seek additional flexibility in their pre-emption rights disapplication authorities beyond that set out in the revised PEG guidelines.

The reasons for issuers electing not to adopt the updated PEG and/or IA guidance may be varied. Firstly, issuers may have decided to "wait and see" how the market reacts to the new guidelines over the course of the year before choosing whether or not to increase their authorities. Separately, issuers may simply have viewed the additional headroom provided by the revised guidelines as unnecessary for their strategic plans, or as potentially problematic for certain of their shareholders.