In July 2022 MedTech Europe published a Survey Report with an analysis of data from the medical devices industry gathered in April 2022. It focused on the delays in certification of general medical devices and active implantable medical devices and included a plea by MedTech Europe for a course correction to avoid the likely scenario of thousands of devices otherwise being excluded from the market.

The Medical Device Coordination Group's (MDCG) 2022-14 Position Paper (the Response) is a direct response to MedTech Europe's Survey Report, containing 19 proposals for action to provide a solution to the certification delays.

Below we discuss whether MDCG's proposed actions are likely to be much of a solution to what's likely to soon become a crisis not only for the devices industry, but also for healthcare providers in the EU, UK and around 100 other countries that rely on CE marking for medical devices.

A precarious situation for recertification of general medical devices

The survey is said to represent 60-70% of the market revenues in the EU. The most concerning statistic is that for more than 85% of devices currently on the market and certified under the Medical Devices Directive (MDD) or Active Implantable Medical Devices Directive (AIMD), certificates had not been issued at the survey date of April 2022.

Manufacturers have been able to obtain EU Medical Device Regulation (MDR) certificates for their general medical devices since BSI Netherlands was certified as a notified body (NB) in January 2019, although it was not until August of 2019 that the third NB was named (DEKRA).

Thus, theoretically and assuming the best-case scenario, the effective total time available for recertification of devices certified under the MDD or AIMD was 64 months (until 26 May 2024 when all certificates under the directives must expire).

Of that time, more than 60% had elapsed by the time the survey was undertaken (39 months of a possible 64). This assumes that all manufacturers have been able to obtain a certifying notified body - in fact 30% of SMEs have not been able to do so.

So, with 40% of the time that was available remaining, 85% of the devices are yet to be recertified - and that's without even considering new devices, up-classified devices (of which there are around 55,000) and in vitro diagnostics (IVDs).

It looks highly likely that a large proportion of devices requiring recertification will fail to achieve MDR certification before time runs out unless drastic action is taken, and soon given the final deadline of 26 May 2024.

The situation for IVDs – probably worse?

The MedTech Europe Survey did not look at IVDs. IVDs manufacturers have been able to apply for certification under the In Vitro Diagnostic Regulation (IVDR) since October 2019 when DEKRA became the first notified body designated under the IVDR. Only seven notified bodies are currently registered in the NANDO database for certification of IVDs under the IVDR.

It is estimated that around 85% of IVDs require certification under the IVDR compared with 10% under the In Vitro Diagnostic Directive (IVDD). To add to the timing and capacity challenges that apply equally to all types of medical device, many specialist IVD companies have never had to obtain certification before, so lack experience of engaging with NBs. Thus, the delays being experienced with general medical devices are likely to be exacerbated for IVDs.

What's the problem?

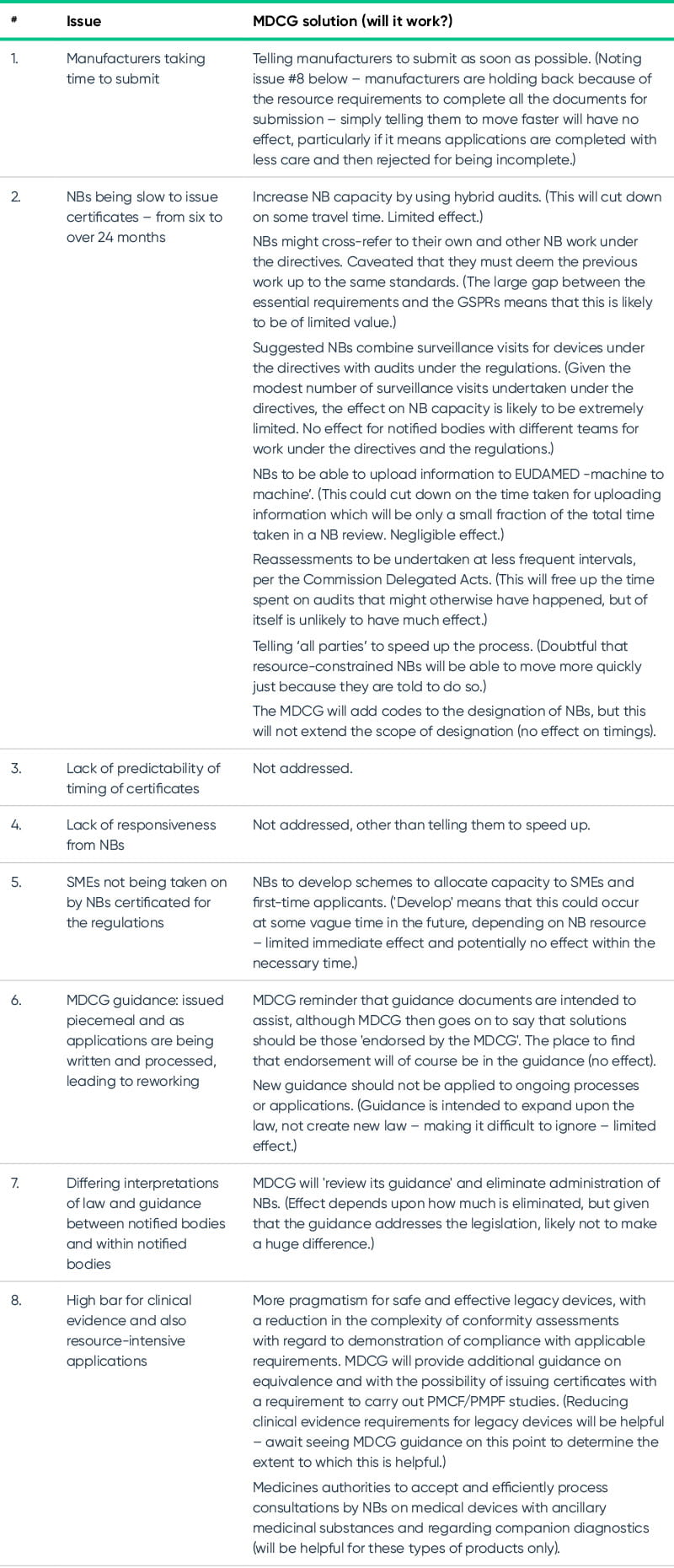

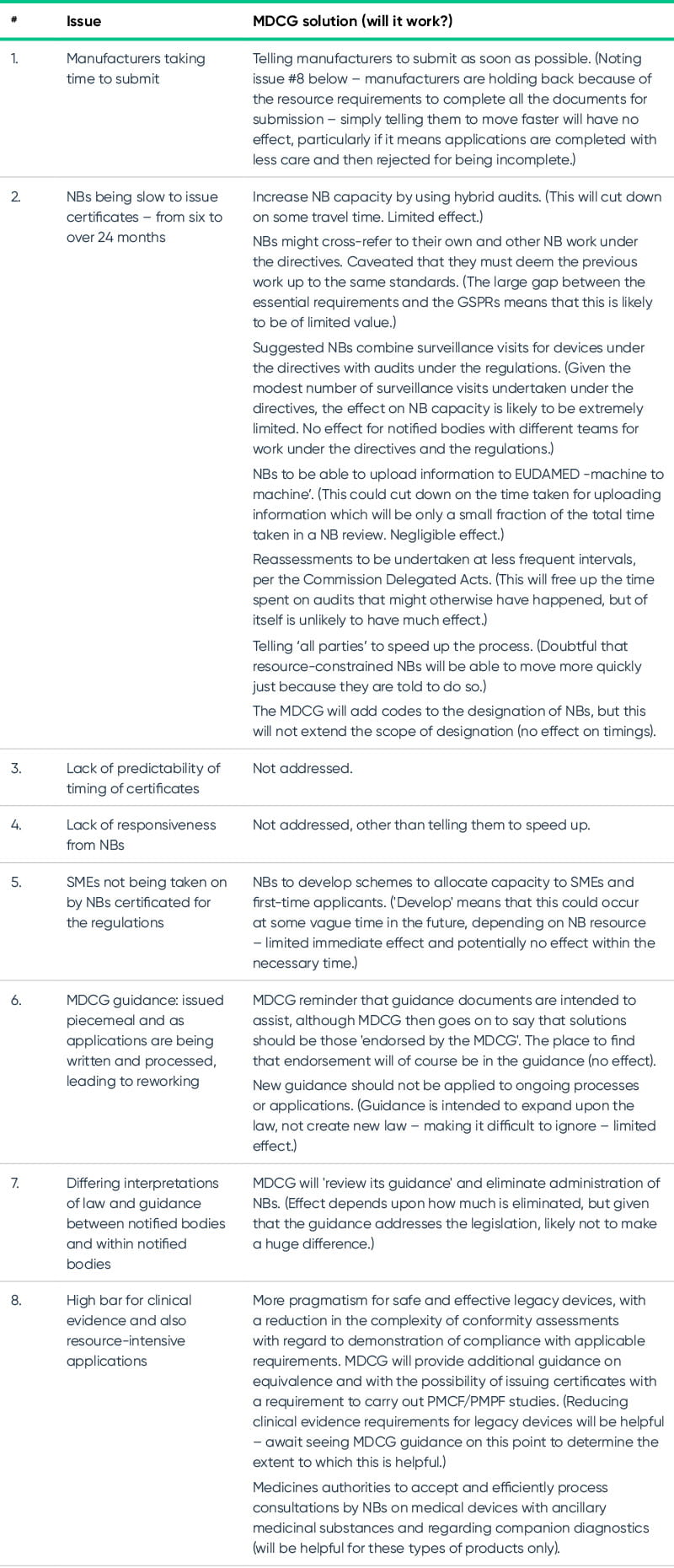

The survey identified a number of issues including the following:

- Slowness of manufacturers in making applications – an indicator of the amount of work involved: submissions data shows that large companies have submitted for 57% of the QMS certificates and 48% of technical files, whereas SMEs have applied for 25% QMS and 30% for technical files.

- Time taken to issue certificates: 13-18 months on average, but with approximately a quarter taking longer, and 9% taking over 24 months. The process is also slower for SMEs. The time for certification is approximately double that under the directives. The higher the classification, the longer the timelines.

- Unpredictability of timing: businesses cannot reliably plan ahead for a specific date for labelling and launch. The range of timings is from less than six months to over 24 months (and we are seeing 30 months for some devices), with only 14% being certified within nine months.

- SMEs (accounting for 26% of anticipated devices on the market by 26 May 2024 and 40% of required certificates) – are unable to obtain designated NBs – with 30% still without: only 7% of SMEs have their certificates issued under MDR compared with the average of 13%. Indications are that SMEs are finding the resourcing requirements for MDR to be too burdensome.

- MDCG guidance being issued in a piecemeal fashion is causing delays: NBs 'upgrade' the requirements part way through, leading to a reworking of the application being required by the NB – applicable to 46%.

- Poor responsiveness: companies say that lack of responsiveness from NBs is a significant issue. Certification requires a level of collaboration between NB and manufacturer, which does not work properly if one party is not responsive.

- Interpretations of the regulations and MDCG guidance vary between and within notified bodies: this might go some way to explain why currently more than 50% of applications have been refused for being incomplete (rather than the MDCG sole explanation that it is due to the 'lack of manufacturers' preparedness').

- Requirements for evidence: requirements for clinical evidence for legacy devices are leading to the decision to discontinue around 33% of devices currently on the market.

Does the MDCG 2022-14 Position Paper provide a solution to the major backlog and delays in certifications under the MDR?

What it means for the medical devices industry and for the EU

If the EU Commission, the MDCG and Notified Bodies do not get to grip with the slow rate of certification of medical devices in the short term, the EU as well as the UK and the approximately 100 other countries relying on the CE mark are going to see a noticeable shortage of medical devices and IVDs in their healthcare facilities.

Manufacturers anticipate that 33% of devices will be discontinued: leading to a less competitive market and higher prices for the devices that do remain available. It is already the case that around 50% of medical device manufacturers are deprioritising the EU market and most are prioritising the US market instead, including EU-based manufacturers. This means that the EU will not be at the forefront of the deployment of innovative devices in healthcare.

Furthermore, the high burden of the regulations mean that we are likely to see SMEs exit the market altogether. SMEs frequently bring the more innovative products to market – further exacerbating the decrease in innovation. This will be felt in European healthcare systems which are already subject to energy and other price increases due to world events.

What should you do if your certificates under the directives look likely to expire before you obtain your MDR certificates

Look out for our next article that offers practical tips for how to manage this situation.