- Home

- News & insights

- Insights

- The UK's National Se…

- On this page

26 July 2021

The UK's National Security and Investment Act

- In-depth analysis

A sea-change in the ability of the UK Government to intervene in transactions – what should you do now?

On 20 July 2021, the Government announced that the National Security and Investment Act (the 'Act') which received Royal Assent on 29 April 2021, will come into force on 4 January 2022. On the same day it also published some initial guidance as well as a draft statutory instrument. More guidance is expected later this year.

The Act establishes a new screening regime for transactions that might raise national security concerns, including a mandatory notification regime in certain sectors regardless of any actual national security risk. The Act captures a large number of transactions and investments in many sectors. Surprisingly, it gives a retroactive power to Government to examine completed transactions from 12 November 2020, a move to prevent companies taking pre-emptive action.

We have already assisted several clients with transactions that might be caught by the retrospective call-in power by seeking informal guidance from the Department for Business, Energy and Industrial Strategy (‘BEIS’) that the transaction does not raise national security concerns.

Overview

The Act impacts a significant number of transactions in key sectors of the economy including company takeovers, acquisition and investments and acquisitions of assets such as intellectual property. The scope of the new regime is striking:

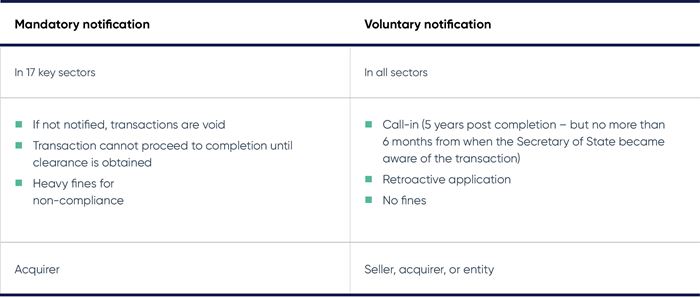

- there is a requirement for a mandatory notification in 17 key sectors of the economy. Notification must be made, and clearance obtained prior to proceeding with the proposed notifiable transaction (with substantial fines for noncompliance)

- in all other sectors parties might decide to notify the transaction voluntarily if it may raise national security issues

- non notified transactions that raise national security concerns might be called-in for review by the Government

- there are no safe harbours on the basis of turnover

- the Act has extraterritorial application (so for example it will apply to US, Canadian, EU or other non-UK entities which carry on activities in the UK or supply goods and services in the UK, even if they do not have a presence in the UK and therefore capturing foreign to foreign deals)

- the Act is country-agnostic, so it also applies to UK/UK acquisitions.

Mandatory notification

The Act introduces a mandatory notification regime applying to notifiable transactions in 17 broadly defined sensitive sectors:

- advanced materials

- advanced robotics

- >artificial intelligence

- civil nuclear

- communications

- computing hardware

- critical suppliers to government

- cryptographic authentication

- data infrastructure

- defence

- energy

- military and dual use

- quantum technologies

- satellite and space technologies

- suppliers to the emergency services

- synthetic biology

- transport.

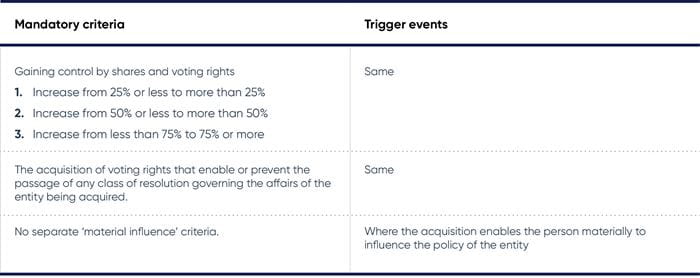

Notifiable transactions will be those where:

- there is an increase of shareholding and voting rights from:

- 25% or less to more than 25%

- 50% or less to more than 50%

- less than 75% to 75% or more, or

- the acquisition of voting rights that enable or prevent the passage of any class of resolution governing the affairs of the entity being acquired.

The Act passed through Parliament mostly unamended with one main exception: the minimum threshold for mandatory filing is now 25%, not 15% as it was in the Bill published in November 2020.

Notifications will have to be made to a dedicated government unit – the Investment Security Unit ('ISU') - through a digital portal.

Mandatory notification will be required regardless of whether the transaction raises national security issues or not. The application across so many sectors and with such low thresholds and with extraterritorial effect will catch a large number of transactions and investments.

The mandatory filing and the suspensory effect are in sharp contrast with the UK merger control regime which is voluntary and with the public interest intervention notices which can be raised if there are certain defined public interest considerations (both covered by the Enterprise Act 2002).

In relation to the definitions for each of the 17 notifiable sectors, the Government issued a consultation and published its response on 2 March 2021 where it narrowed and/or clarified the scope of the definitions in seeking to respond to the concerns that the sectors were too broadly defined and could prevent acquirers from identifying whether they will fall within the mandatory notification regime. The definitions are now contained in the draft statutory instrument published on 20 July 2021. The definitions are broadly similar to the ones contained in the response, but substantial amendments have been made to the definition of communications, data infrastructure, energy, suppliers to emergency services as well as synthetic biology.

Taylor Wessing submitted comments to the Government as part of its consultation on the sectors leveraging our expertise in the Life Sciences and Technology sectors in particular, raising concerns with how broad many of these sectors were, in particular Artificial Intelligence, Communications, Engineering Biology (now renamed as Synthetic Biology) and Quantum Technology. We contended that those definitions would catch entities that pose no risk to national security and did not reflect how dynamic and fluid these sectors are. We also submitted comments on the Bill more generally to the Bill Policy Committee in December 2020. We are continuing to engage with Government, in particular on the definitions of the 17 sectors.

Voluntary notifications

For other sectors of the economy that are not among those 17 designated mandatory notification sectors, notification will be voluntary if the transaction raises national security issues. It should be noted that the Act does not contain a definition of national security and the Government resisted calls during the Parliamentary process to define it, giving itself a wide margin of discretion.

Call-in powers and retrospective application

If there is a trigger event, the Government will have the power to call in transactions that have not been notified (but which raise national security concerns) for a period of five years following the date of the transaction, as long as the Secretary of State acts within six months of becoming aware of the transaction (for example from the press).

A 'trigger event' under the voluntary notification regime has some differences to those under the mandatory regime. The same 25%, 50% and 75% thresholds apply but there is also a 'material influence' trigger, applicable where a person acquires the power to influence materially the policy of the target.

In addition, the Government will be able to retroactively call-in any transactions closing from 12 November 2020 for review if there is a 'trigger event' and there are potential national security concerns. Until the Act enters into effect in January, parties may wish to consider writing to the BEIS in advance of closing the transaction seeking non-binding guidance that BEIS will not call in their transaction. The call-in will apply to any sector of the economy but parties operating within the 17 notifiable sectors may be particularly keen to assess the potential risk of their transaction being called in.

Assets

The Act also captures transactions involving a broad range of assets including land, tangible and intangible assets such as certain IP rights (which will be clarified later in secondary legislation). These transactions will not subject to mandatory notification but might be called in if they raise national security issues. On 20 July 2021, the Government issued guidance for universities and research organisations on this topic.

Extraterritorial effect

Another guidance document published on the same day deals with how the Act will affect people or acquisitions outside the UK. The Act has extraterritorial effect, so it could for example apply to a transaction or investment between two US entities if the target carries on activities in the UK or supplies goods or services to persons in the UK. Similarly, assets transactions between US entities could be caught even for non-UK assets, if used in connection with activities in the UK or supply of goods or services to persons in the UK.

Sanctions

Closing a transaction that is subject to mandatory notification without notifying and obtaining clearance will carry heavy fines: up to 5% of total worldwide turnover or £10 million (whichever is greater) and imprisonment up to five years, and such transactions will be void.

Government approach and timetable

The UK has been an outlier relative to several its peers in not having a national security investment regime of this nature. The Government intends to take a proportionate approach, to limit these powers to national security risks and not to interfere arbitrarily with investment. It expects the vast majority of notified claims to be given clearance to proceed and it aims to support foreign direct investment in the UK rather than to limit it, but it is clear that these new rules (and similar rules in other jurisdictions such as Germany and the Netherlands) will have an increasing impact on transaction timelines, certainty of closing and costs.

A clearance decision should take about 30 working days from the Secretary of State's acceptance of the notification, but a full national security assessment can be estimated to be up to 21 weeks.

The Secretary of State will make its assessment based on:

- The target risk: the nature of the target and whether it is in an area of the economy where it could be used in a way that poses a risk to national security

- The control risk: the type and level of control being acquired and how this could be used

- The acquirer risk: the extent to which the acquirer has characteristics that may be a risk to national security.

Upon notification, several outcomes are possible: clearance, clearance with conditions or prohibition (or, in extreme circumstances, unwinding the transaction). The Government has wide powers to impose conditions, for example altering the amount of shares an investor is allowed to acquire, restricting access to commercial information etc.

A Government estimate of receiving around 1000 -1800 notifications under the Act a year seems conservative in our view.

Although the Government acknowledges that many transactions will be approved without conditions, recent high-profile cases demonstrate the Government’s resolve to vet transactions that raise national security concerns. It is of interest in this regard that on 19 April 2021, the Secretary of State for the Department for Culture, Media and Sport issued a public interest notice for the proposed acquisition by the US Nvidia Corporation of the UK company ARM, active in semi-conductors. We expect a decision soon, since a report by the UK competition authority on the deal has been presented to the Secretary of State on 20 July 2021.

In relation to the Act, the CMA, the UK Competition Authority, will continue to be competent for transactions that raise competition law issues if the thresholds for a competition law assessment are met. This process and the national security vetting will proceed in parallel but with different timeframes and might have a significant impact on the timing of the completion of deals.

Immediate relevance to you

We have set out the main provisions above. The Act will have legal effect in January 2021. Several pieces of secondary legislation are being prepared and BEIS is also active in preparing guidance that should assist businesses, with the first set of guidance recently published.

However, we would like to draw your attention to two points where immediate action might be necessary/desirable:

- potential applicability to live transactions - if you are considering a transaction involving the acquisition/sale of or an investment in a UK Company or in the UK (or involving an overseas business that has activities or sells into the UK) that might raise national security issues you may wish to consider seeking informal guidance from BEIS that the transaction does not raise any concern, especially (though not only) if you are active in any of the 17 key sectors mentioned above

- although the consultation has now closed and the definitions of the 17 key sectors is in the draft SI, the Government is still listening to concerns and is still open to considering ways to properly define some of the 17 key sectors that are subject to mandatory notification.

Conclusion

In a period of many challenges, the severity and scope of this new regime may come as a surprise to businesses, but it is part of a trend we have seen in many countries, including in Europe, to strengthen national security rules. It is clear that many more transactions will need to be notified in this new environment. For many larger M&A deals this may just be one additional clearance to be obtained before closing. We anticipate more of a marked impact on mid-market and smaller transactions and fundraisings, which may otherwise have signed and completed simultaneously, and for which the additional time, cost and process will have a more disproportionate effect.

Further reading

We encourage you to take a look at the Government's response to the consultations on sector definitions as well as the documents published on 20 July 2021:

- NSI: draft SI

- National Security and Investment Act: guidance for the higher education and research-intensive sectors

- The National Security and Investment Act alongside regulatory requirements

- How the National Security and Investment Act could affect people or acquisitions outside the UK

- National Security and Investment Act: prepare for new rules about acquisitions which could harm the UK’s national security

If you would like to discuss The Act, its impact on any proposed transaction and/or the sector consultation with us, please let us know.

Related Insights

Word on the street at the J.P. Morgan Healthcare Conference 2025

by multiple authors

DMCC Act: helping small businesses compete against tech giants?

Life sciences M&A roundup: October 2024

by Ross McNaughton and Sarah Cole